Interview with Dr. David Yeh

In this week's podcast episode, Dr. David Yeh describes how to invest wisely when preparing for a career pivot.

David is a practicing physician, speaker, author, investment advisor, and founder of The Wealthy Doctor Institute. He is also a Registered Investment Advisor.

He is an alumnus of Cornell University and New York University School of Medicine. Following medical school, he completed residencies in radiology at SUNY Stoney Brook University Hospital and Nuclear Medicine at the University of Pennsylvania Health System. And he is board certified in Radiology and Nuclear Medicine

Our Sponsor

We're proud to have the University of Tennessee Physician Executive MBA Program, offered by the Haslam College of Business, as the sponsor of this podcast.

The UT PEMBA is the longest-running, and most highly respected physician-only MBA in the country. It has over 700 graduates. And, unlike other programs, which typically run 1 – 1/2 to 2 years, this program only takes a year to complete. Recently, Economist Magazine ranked the business school #1 in the world as the Most Relevant Executive MBA.

While in the program, you'll participate in a company project. That will enable you to demonstrate your commitment. And, as a result, the UT PEMBA students bring exceptional value to their organizations.

Graduates have taken leadership positions at major healthcare organizations. And they've become entrepreneurs and business owners.

By joining the University of Tennessee physician executive MBA, you will develop the business and management skills needed to find a career that you really love. To find out more, contact Dr. Kate Atchley’s office at (865) 974-6526 or go to nonclinicalphysicians.com/physicianmba.

Invest Wisely

After discussing David's background, he quickly gets into the basic principles that we should apply to long-term investing. The most basic way to invest wisely is to adopt an approach that limits losses.

Having a plan, even a simple one-rule plan such as dollar-cost averaging, gives you an edge over investors who have no plan. – Dr. David Yeh

According to David's analysis, the best outcomes come from following a plan, reviewing your portfolio, and applying adjustments monthly. Focussing only on trying to identify winning investments does not work.

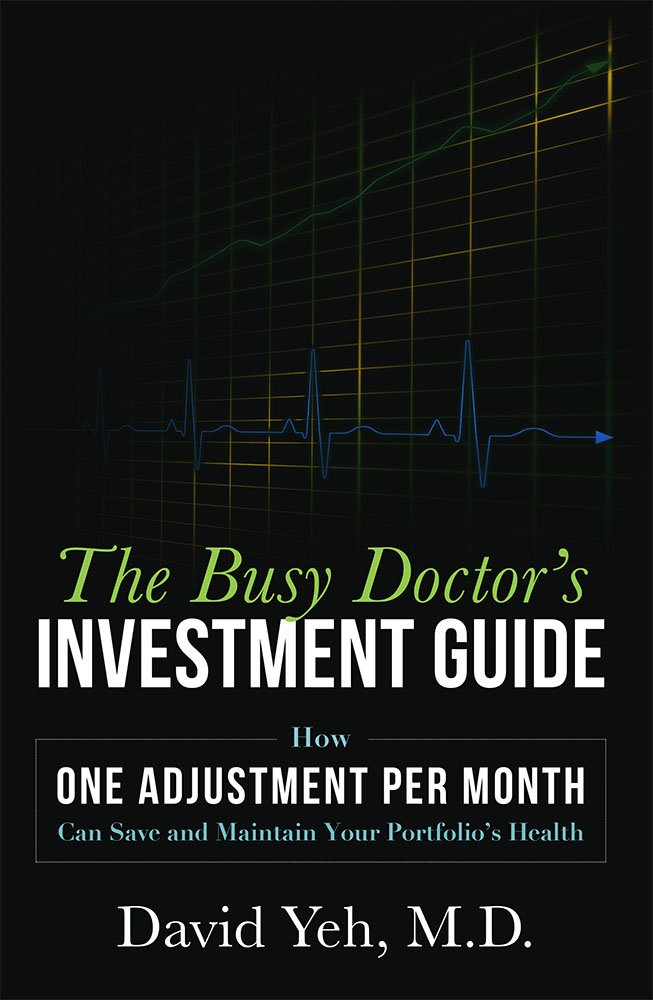

Writing His Book

David explains the process he used for writing and publishing his book, The Busy Doctor's Investment Guide. With the assistance of his publisher, Advantage Media Group, he was able to capture his idea and complete the book quickly. Its staff helped him to organize the content, and teach readers how to invest wisely.

The book is clearly written and highlights several loss-mitigation strategies. It also covers the basic principles that every investor should know. One chapter is devoted to investor psychology.

Preparing for a Career Pivot

David recommends we stick to the basics when preparing for a career pivot. It is likely that there will be a temporary reduction in or loss of income. So, it's best to be debt-free. And you should have a sufficient emergency fund and capital for living expenses, based on the projected time needed to complete your pivot.

If starting a new business, a business plan and financial projections must be prepared. And you should double the projected time to break-even and expenses during the first year. An overly optimistic business plan has sunk many small businesses.

Wealthy Doctor Institute

Today, David still practices part-time radiology. He considers himself semi-retired from clinical practice. He also runs his business, Wealthy Doctor Institute, and manages an investment fund. His philosophy is to be a coach to his clients and to be transparent in how funds are invested.

Summary

Dr. David Yeh successfully balances two careers: medicine and investing. In this week's interesting interview, we learn how he accomplished it. And we've identified a resource that physicians might use to help direct their long term investments.

Links for Today's Episode:

- The Busy Doctor's Investment Guide

- Advantage Media Group

- Wealthy Doctor Institute

- Wealthy Doctor Institute Facebook Group

- Dr. David Yeh's LinkedIn Profile

Download This Episode:

Right Click Here and “Save As” to download this podcast episode to your computer.

The Nonclinical Career Academy Membership Program recently added a new MasterClass!

I've created 17 courses and placed them all in an exclusive, low-cost membership program. The program provides an introduction to dozens of nontraditional careers, with in-depth lessons on several of them. It even includes my full MSL Course. There is a money-back guarantee, so there is no risk to signing up. And I'll add more courses each month.

And to make it even easier, listeners to this podcast can get a one-month Trial for only $1.00, using the Coupon Code TRIAL at nonclinicalphysicians.com/joinnca. The $1.00 introduction to the Academy ends on November 28, 2020.

Thanks to our sponsor…

Thanks to the UT Physician Executive MBA program for sponsoring the show. It’s an outstanding, highly rated, MBA program designed for working physicians. It is just what you need to prepare for that fulfilling, well-paying career. You can find out more at nonclinicalphysicians.com/physicianmba.

If you enjoyed today’s episode, share it on Twitter and Facebook, and leave a review on iTunes.

Podcast Editing & Production Services are provided by Oscar Hamilton

Disclaimers:

Many of the links that I refer you to, and that you’ll find in the show notes, are affiliate links. That means that I receive a payment from the seller if you purchase the affiliate item using my link. Doing so has no effect on the price you are charged. And I only promote products and services that I believe are of high quality and will be useful to you, that I have personally used or am very familiar with.

The opinions expressed here are mine and my guest’s. While the information provided on the podcast is true and accurate to the best of my knowledge, there is no express or implied guarantee that using the methods discussed here will lead to success in your career, life, or business.

The information presented on this blog and related podcast is for entertainment and/or informational purposes only. It should not be construed as medical, legal, tax, or emotional advice. If you take action on the information provided on the blog or podcast, it is at your own risk. Always consult an attorney, accountant, career counselor, or other professional before making any major decisions about your career.

Leave A Comment

You must be logged in to post a comment.