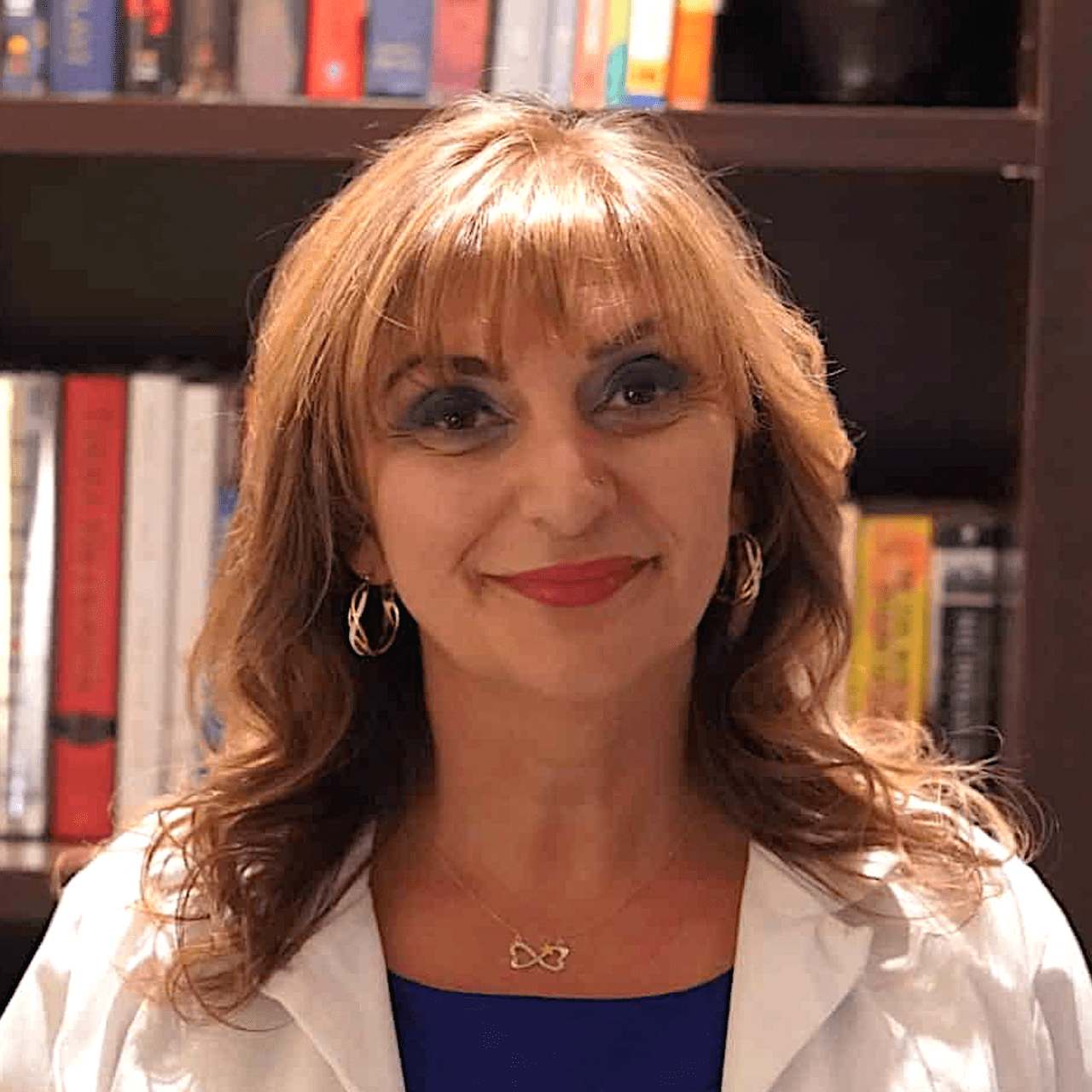

Interview with Dr. Judy Finney – 365

In this podcast episode replay, I'm speaking with Dr. Judy Finney, an interventional cardiologist who transitioned to the amazing field of life insurance medicine in 2012. She describes her career journey and provides insights for those considering this unique career.

At the time of the interview, she was serving as an Associate Medical Director. Since then, she worked for 2 years as Medical Director and moved to Vice President for a major mutual insurance company earlier this year.

Our Show Sponsor

We're proud to have a NEW EPISODE SPONSOR: Dr. Armin Feldman's Prelitigation Pre-trial Medical Legal Consulting Coaching Program.

The Medical Legal Consulting Coaching Program will teach you to build your own nonclinical consulting business. Open to physicians in ANY specialty, completing Dr. Armin Feldman’s Program will teach you how to become a valued consultant to attorneys without doing med mal cases or expert witness work.

His program will enable you to use your medical education and experience to generate a great income and a balanced lifestyle. Dr. Feldman will teach you everything, from the business concepts to the medicine involved, to launch your new consulting business during one year of unlimited coaching.

For more information, go to nonclinicalphysicians.com/mlconsulting or send an email to armin@mdbizcon.com.

For Podcast Listeners

- John hosts a short Weekly Q&A Session on any topic related to physician careers and leadership. Each discussion is posted for you to review and apply. Sometimes all it takes is one insight to take you to the next level of your career. Check out the Weekly Q&A and join us for only $5.00 a month.

- If you want access to dozens of lessons dedicated to nonclinical and unconventional clinical careers, you should join the Nonclinical Career Academy MemberClub. For a small monthly fee, you can access the Weekly Q&A Sessions AND as many lessons and courses as you wish. Click the link to check it out, and use the Coupon Code “FIRSTMONTHFIVE” to get your first month for only $5.00.

- The 2024 Nonclinical Summit is over. But you can access all the fantastic lectures from our nationally recognized speakers, including Dr. Dike Drummond, Dr. Nneka Unachukwu, Dr. Gretchen Green, and Dr. Mike Woo-Ming. Go to Nonclinical Summit and enter Coupon Code “30-OFF” for a $30 discount.

[From the original post in 2018:]

Today I present my interview with Dr. Judy Finney. I've been hoping to get an expert in Life Insurance Medicine on the show for many months. I was able to link up with Dr. Finney after seeing her quoted in a blog post by Heather Fork at Doctors Crossing.

Judy completed undergraduate studies in zoology, and medical school, at Michigan State. She completed an internal medicine residency and fellowships in cardiology and interventional cardiology and became board-certified in all three disciplines. She built a private cardiology practice, then opted to work for a large group for the final 3 1/2 years of her clinical career.

Six years before our interview she moved into life insurance medicine. She works full-time in the amazing field of life insurance medicine. However, she also finds time to work as a speaker and mentor at the annual SEAK Nonclinical Careers for Physicians Conference each October.

Pursuing a Career in the Amazing Field of Life Insurance Medicine

Judy does a great job during our discussion addressing several issues:

- Her career path from interventional cardiologist to full-time Associate Medical Director;

- Her advice on how to increase your odds of getting a job in life insurance medicine;

- The personality traits that are most compatible with such a career;

- Some of the adjustments that will need to be made when pivoting to this type of position;

- Resources that can be helpful for the prospective life insurance medical director, such as:

- Brackenridge's Medical Selection of Life Risks: Fifth Edition

(note: this is an Amazon affiliate link).

- American Academy of Insurance Medicine (AAIM)

- Midwestern Medical Directors Association

- SEAK’s Annual Non-Clinical Careers Conference

- LOMA (Life Office Management Association)

- Dr. Armin Feldman's Prelitigation Pretrial Medical Legal Consulting COACHING Program

- Brackenridge's Medical Selection of Life Risks: Fifth Edition

Summary

By following Judy's advice, you can accelerate your pursuit of a career in the amazing field of life insurance medicine. I hope you found this episode helpful. If so, please subscribe to the podcast on your favorite smartphone app or iTunes. Join me next week for another episode of Physician Nonclinical Careers.

Podcast Editing & Production Services are provided by Oscar Hamilton

If you liked today’s episode, please tell your friends about it and SHARE it on Facebook, Twitter, and LinkedIn.

Right click here and “Save As” to download this podcast episode to your computer.

Transcription PNC Podcast Episode 365

The Amazing Field of Life Insurance Medicine - A PNC Classic from 2018

- Interview with Dr. Judy Finney

Jurica: It's my pleasure to welcome Dr. Judy Finney to the PNC podcast. Hello, Dr. Finney.

Finney: Hello.

Jurica: Thanks for joining me today. This is going to be great because I've been trying to find someone to talk to about the life insurance industry and the physician positions in that industry since I heard about it about a year ago. And I came across an article by Heather Fork and I think she was quoting you in the article.

So I thought you would be perfect, a perfect person to answer the questions for our audience today.

Finney: Well, that sounds great. I met Heather at a conference for physicians who are contemplating career change called SEEK and so I have really run into her the last several years annually and we talk all the time about positions including in my field.

Jurica: That is just perfect because my audience is pretty much the same as the people that would tend to come to the SEEK conference. So let's just get into this then. Why don't you tell us first about what it is that you do in your position as a life insurance physician, if that's what I would call it, but you can explain that to us if you would.

Finney: Okay. Well, I'm employed by Allstate, which is actually a combined insurance company and it really does a lot of property and casualty, home and auto, but they always have had a certain portion of their business in life insurance. And in fact that end of the business is actually growing for Allstate.

So my boss was actually in his position, I think for about five or six years before he hired me as the second physician and we're now up to four physicians who work in the life insurance medical department at Allstate. And primarily what we do is in underwriting, which is basically a risk assessment of potential mortality for people that are applying for life insurance policies. There's other physician positions at other organizations that sometimes do a little more than that.

They might work in claims, which are things that need to be assessed after the fact of a death, or they might work in underwriting research and policy or writing reinsurance manuals, but at Allstate we don't necessarily do those functions. We are very concentrated in underwriting. So as my job basically involves a lot of communication with underwriters who are a professional group of people.

In Allstate, they usually number around 90 to 100 people scattered across the country who are doing sort of preliminary review of life insurance applications. And that review would actually include some non-medical things, but it also includes medical things. And so I serve, as do my fellow physicians, as resources for those underwriters.

They would tend to send us cases which are more difficult or more complex or have more medical problems instead of being very simple. They're pretty experienced, so they tend to be able to handle the simple ones themselves. But the more complex things get, the more they might need some medical review.

And especially if something was rare or unusual, or it took a lot of what I guess what I would call weighing and measuring, that would be the kind of case that would come to the medical director in the life insurance underwriting department at Allstate. And that case would involve their review. So they make an assessment of the medical records and send me their thought process plus the actual medical records themselves.

My job would be to review all of that and then I have various resources I can use in order to help judge mortality risk and I would send back an answer to that underwriter. So I would assess the risk, but I would also assess their evaluation. And thereby, case by case, I'm literally doing one-on-one education and training.

So I would say that portion of my job takes up about 50 to 60 percent of my time on a day-to-day basis. And about, I would say, 20 to 30 percent of my time is spent doing other things that are also educational, but they're not based on a single case. So for instance, I might give a webinar over the computer or through Skype or other sources in which I would teach about a specific topic.

Now, I happen to be a cardiologist, so I will tell you that they very often ask me to speak about cardiology topics, you know, and this might be hypertension or coronary disease or coronary calcium scores or the tiny important details in echocardiograms, but many times it's often in non-cardiology topics. For instance, multiple sclerosis or anemia or adult survivors of childhood cancer. Those are all topics that I've given various talks on in the past.

And then the smaller fraction of the rest of my day or my week would be to serve as a resource to other departments in the corporation. It might be the legal department or it might be the underwriting research and policy department or perhaps one of the executives in the c-suite who has a particular interest because they've read something in the Wall Street Journal or the New York Times and they want a medical assessment as to how this impacts our industry and specifically our corporation. So my job involves a lot of reading, answering, communicating, educating, that kind of thing, but it might differ as to who I'm doing it to and for and at what level of detail.

Jurica: Of those things that you're doing, are there certain parts that you find particularly satisfying or interesting?

Finney: Well, I actually like this job quite a bit. And what I would say is I always did like teaching, including when I was a clinician. So it didn't surprise me to have the teaching parts of this be very satisfying.

But I think I also was a person who really, a physician who really liked the puzzle, figuring out the puzzle. So to have cases that I'm thinking about, reviewing, and then doing what I mentioned before, the weighing and the measuring, in a lot of ways that whole function is part of being a clinician all the time. All the time you're taking in information and you're weighing risks and benefits and applying it to your own personal experience and your knowledge of the medical literature and trying to come to some conclusion.

So those are really transferable skill sets and that kind of thing is the same kind of function that you do. It's just that you do it from the lens of mortality risk assessment in various medical impairments.

Jurica: Very interesting. So it's clearly a non-clinical job, but like a lot of our non-clinical jobs that really, there's a lot of overlap with what you learn during your education and training as a cardiologist and interventional cardiologist and so forth. So that's good to know.

But maybe we can step back for a minute and you can explain sort of how did you make that transition and why from a practicing cardiologist?

Finney: Well, I'm not sure everybody should do it my way. Maybe that's one thing I should say from the start. I sort of did my transition in a more desperation mode and a setup to here mode and I don't always think that's really a really great way to make decisions.

It's just that it worked out for me. But you know trusting to luck may not be really the right way to handle it. I was actually one of those people that really truly loved my job, loved my field and if you really had asked either myself or anybody that knew me during all the years that I was in cardiology, which were quite a few, they would have told you that I probably would be one of those people that would die with my boots on still practicing.

And I would have told you that also. It's just that the last few years that I was in practice and I basically stopped doing clinical practice in September of 2012. I found like many physicians find is that they're really not in control of their destiny anymore and they also what they signed up for is not exactly what was happening.

And so it was I think a gradual transition over time and I did try to solve it in other ways. I had my own practice. I was in private practice and I created a group and I grew the group to a pretty good size and my first assessment of this was that I was simply burnt out from being both very administrative in my practice as well as clinically involved.

And I was just burning the candle at both ends. And so I thought I would solve it by getting out of my own practice and moving to another actually larger cardiology practice where I could devote myself to just being clinical. And I lasted in that for about three and a half years, but it sort of became clear to me that the same challenges that I faced in my practice, many of which I think were external to the practice, they were still affecting this other larger practice as well.

And so I sort of gradually came to the conclusion that it wasn't just me or just my circumstance, but it was a larger issue. And yet I felt that I didn't really want to just retire. I felt like I still had more to give and I really enjoyed using my brain and I just didn't want to work 100 to 110 or 20 hours a week.

I just felt like it was sort of unfair to ask me to do that. But I couldn't really find a good way in cardiology, in the city I was in with the circumstances that existed, to downsize. So that's when I became more open-minded to looking around to other things.

And I was still working at the time and I kept looking and looking and, you know, to be honest, feeling more and more desperate. So one of the ways that I looked is I actually asked a couple of friends that went all the way back to medical school who had made the transition to life insurance medicine years before. I asked both of them if they thought I could do that job and would I be good at it and would it be good for me?

And of course because they knew me, they could give me good honest assessments and they said, yes, this would be great. It would be great for the field and great for you, etc. And I had had one helpful experience, which was some five years before that I was asked to be a guest speaker on a cardiology topic at one of their regional meetings.

So I had met a whole bunch of people in life insurance medicine already and I didn't just stay for my own talk. I stayed for the entire meeting and I got a chance to meet, you know, 40, 50 people who were in the field and they were singularly happy. so it impressed me and I think it just kind of sat in the back of my brain.

I kept thinking, when's the last time I've been in a room full of happy doctors? And that's really why the idea of insurance medicine came. And then when it did, I contacted my friends and tried to sort it out.

Now I will tell you that I didn't, you know, despite making the decision that this was a good place to go into or to transition into, I still didn't get any interviews for probably six to eight months. And so I put my resume out. They tried to help me a little.

They told me some things I could do to prepare myself a little better and become sort of a better candidate. But because the people in the field are pretty happy, it's not like there is enormous turnover in the field. I think there will be some and I have spoken about this and written about it before.

It's because a lot of the people in the field are now in the age group where one would expect retirement. But there's also some changes that are happening in the field. Some companies are buying other companies.

So there's some contraction. And there is some automation of processes. So because of that, I'm not totally sure that what I anticipated five years ago about the number of retirements.

I'm not sure that that will really be exactly the same. It might be less.

Jurica: Okay.

Finney: I will tell you my experience is that most people who go into this enjoy it a lot. And so they don't really leave. And they don't necessarily leave voluntarily.

Or if they do, they just leave to go to another company and do the same thing. So that's one key sign that people are generally happy with the field, you know.

Jurica: Yeah, in my conversations with a few people I have spoken with, there's been a pretty much a consensus that most physicians in this field are happy with their careers and glad they made that choice. I want to go back for one second. You know, you're talking about how your colleagues or friends said, well, hey, you know, you'd probably be good at what we're doing.

Do you feel like there's certain traits that would be either favorable towards working in that sort of position or traits that would say, no, maybe something else would be better? Any ideas on that?

Finney: Yes, I think so. I mean, I get asked this question sometimes by physicians who come to me just like I went to my friends. And what I would say is that you have to understand that a great deal of this work involves reading and then typing back answers and communicating one-on-one with people.

So it's a production-oriented environment. And also in general, I would say the person who does this as a physician needs to understand that they are in a whole new environment, a corporate environment, in which the physician is not the so-called buck stops here final arbiter of many things, including individual case decisions. And that transition, I think, would be hard for some people.

When I first made the transition and I was working for a while in life insurance medicine, I kind of wondered to myself, out of all the cardiologists I knew, and maybe especially interventional cardiologists, how many did I know that I thought would actually be able to make a successful transition where they weren't the king of the ship anymore? And I think the number might be small. So I think it helps to be able to have a mindset that you're part of a team and you're a smaller cog in the really large wheel.

So what I would say is that's a quality that you would either have to have or develop. I think that you also should understand that you're only one piece of the puzzle. You are the medical piece.

You are the medical expert that people are consulting for your medical knowledge. But you are not the only person that is participating in this decision. Because this is a business and the business is to sell insurance policies.

So there always has to be some give and take on a lot of the non-medical factors that go into the decision of whether to extend an offer. So that's one thing. I would also say that most people don't understand that although they may know a lot about medicine, they probably don't know much about actuarial science.

And although you don't have to become an actuary, I think you have to. This is a very difficult field to make a sudden leap into from one day doing your clinician job to the next day suddenly going into this field and being able to do the kind of work you need to do and communicate with the people you need to communicate with if you don't have some background knowledge about insurance and actuaries and their vocabulary and how they do their calculations, etc. So I did not find that I had to become an actuary, but I had to learn how to think like one and I had to learn how they come up with some of the things that they come up with, etc.

So you can't do that in a day. And what I would say is because the jobs are fewer and because the competition is growing because the field is so pleasant, it's helpful to distinguish yourself by making some moves to get yourself a little bit more trained or familiar.

Jurica: Okay, so great segue. So your story is unique like everybody's, but now that you have this experience and you're looking back and people are coming to you, so what would be sort of the ideal way to prepare oneself and position oneself to be attractive to an employer?

Finney: Well, I think I will talk about some specific background for life insurance. But one thing I would say which people should understand is that it's very difficult to find a part-time job in this field. They almost all are full-time jobs.

But what you can do, I think, is develop what I call transferable skills. So there are many jobs that are in similar fields that have transferable skills and many more of those can be part-time. So that's one way somebody who's working as a clinician but wants to make a transition could kind of dip their toe in the water and just make absolutely certain they like what they're doing, they can perform, they can live within the parameters, that kind of thing.

For instance, people who do utilization review or quality assurance review in which you are given cases, you have to make assessments, you have to give written responses, you have to perform your duties within certain project time frames or turnaround time frames. Those are all things where you can demonstrate very similar skills and performance and see if you like how that goes, how that day goes, and see if it suits you. Those are fields that have many more part-time and project limited opportunities.

So you literally could sort of demonstrate your skills. So I often advise people to try to do something like that and put that right near the top of their resume when they're looking into life insurance because that's the kind of thing where people will sit up and pay attention and realize that you've gone the extra mile to try to train in the skill set. In terms of education, there is sort of a bible of life insurance medicine and although it's expensive, I think it's really worth purchasing if you're serious.

I got my bible through Amazon and so it's available. It's called Brackenridge's Medical Selection of Life Risks. It's this enormous textbook and the whole first half of the textbook is really demonstrating life insurance as a history, how it came about, and how people did the calculations and some real basic things about mortality and morbidity calculations, how actuaries think, terminology, and then the whole back half of the textbook is very disease and impairment specific.

So once you get the basics, how do you apply them to various disease states that we see? When we read medical records, so that's one thing. Another thing is there's a whole formal organization for medical directors, which is national, which is called AIM, A-A-I-M, American Academy of Insurance Medicine, and it is national.

There are some international people that come to it, but it is mainly intended for physicians in the United States who work for various insurance companies, primarily life insurance, but some disability insurance and some critical illness insurance. And so we have an annual meeting for AIM that happens every year. Most years are two and a half days long.

CME credits can be earned and then every third year is what we call our triennial meeting and that meeting is five days long. And once again, you can earn CME credits. There's a whole lot of people in the field from many, many companies who come to that so you can make contacts.

It is not limited to people that are already in the field. And usually at least 50 percent or more of our speakers are actual clinicians who practice at universities and come and give us updates in various medical fields. Because one of the things is you have to keep yourself updated in what's going on in clinical medicine in order to be able to read medical records and tell the importance of various things that you're reading.

So going to one of these national meetings, I think is very useful both for contacts and for information. We also have regional meetings that take place. For instance, this particular year, I'm the president of the Midwestern Medical Directors Association or MMDA.

And that is a regional association for life insurance companies that are generally in the Midwestern state. And we have a meeting every May and so there are probably 40 plus people who attend our meeting who are medical directors, but we also are open to people who aren't in the industry yet. And we usually have, I would say, anywhere from two to five people that are coming to our regional meeting and making contacts and seeing what kinds of educational opportunities we have, etc.

There's also a national underwriting association, which is you know really meant for underwriters, but they do an enormous amount of very basic training both online and with textbooks, etc. And they're called LOMA, L-O-M-A. And Life Office Management Association is what that stands for.

And they have a website www.loma.org So they also provide underwriting type training and if you're totally green and don't know anything about underwriting, they have some very basic courses that would be able to bring you up to speed and they're not terribly expensive, etc. Another very useful thing for people that are truly serious is that AIM has a specific basic mortality course that they advertise. And the course is very interesting and it pairs you with a mentor and takes you through some mortality calculations with homework over about a six-month period with feedback back and forth between you and the mentor.

And then it culminates in a one to two-day meeting, which is piggybacked on to one of the national or regional meetings where you can have a review and then take a test and get a certificate. So doing things like this in terms of reading, courses, meetings, and especially that basic mortality course, those are all ways that people could prepare themselves so that they look appealing to a hiring manager who is looking to hire somebody who's never been in the field before.

Jurica: Well, that's a lot of really good information and it would take someone hours and hours just to start looking into some of those things. I will provide show notes, links to the various organizations and so forth that you've mentioned. So that'll be fantastic.

I know the listeners are going to appreciate that. Sounds good. Now, let's see.

Any other thoughts or I guess one of the questions I had is whether there's some kind of newsletter or any kind of journal that is produced either from one of those organizations or just in general that addresses this topic?

Finney: We used to actually have a journal that was literally published, but now it is published electronically on the AIM website. So it's called JIM, J-I-M, Journal of Insurance Medicine, and comes out quarterly. And you can get at it through the AIM website and I'm sure I'll provide these things to you so that you can have links.

In general, you know, you have to be an AIM member, but people who are not yet in the insurance medicine industry can in fact become an AIM member just like they can through the MMDA that I mentioned.

Jurica: Awesome. That's great. Well, let's see.

We're getting close to the end here. I did want to circle back a little bit because you mentioned the SEEK meeting and I believe you're scheduled to speak again this year. I didn't know if you want to talk a little bit about that.

Finney: Sure. I think SEEK is a very useful thing for physicians considering transition to go to. I will tell you that I was unaware that they existed before I made my transition, but I wish I had known about them.

Because one of the things that astonished me the most the first time I went was how many fields are out there and how many non-clinical opportunities there are for physicians. It just was astonishing to me. So I really got invited to go there because a hospitalist that I knew provided my name to them as somebody in life insurance that he thought would be a good speaker for them.

So they called me. So that very first year I basically gave a 45-minute talk kind of like this all about life insurance medicine with some slides and talked about, you know, making the transition and what did it take and what was involved that kind of thing. So they have those kind of opportunities at SEEK where people in particular fields already come and talk about how they made their transition and what's involved in their field.

And usually attendees can pick and choose which one of these various talks they would like to go to according to their level of interest. But they also have an opportunity which I've also participated in now which is kind of called mentorship in which you sit at a table in a large ballroom and you do almost like a speed dating kind of experience in which people sign up to have little individual 15-minute visits with a person in a particular field and they talk back and forth about their own personal experience. They get to ask questions.

So you kind of have a one-on-one interview with people who are interested in your field. So I've done both the talks and the mentorship. I tend to create a handout for mine because it's really hard to cover everything in 15 minutes and because I think it's useful for people to have something they can walk away with.

Jurica: Very nice. No, I bet they really appreciate that and I have been to one of the meetings and it is an eye-opener the first time you go just to see so many people interested in change and so many different careers out there that you maybe hadn't even imagined. So I bet they're very happy to have someone such as yourself to be able to talk to the insurance industry because I know they like to have people that are pretty experienced and knowledgeable and can give some practical advice.

So that's very helpful. All right. Well, I think we're going to wrap it up then here. There might be some questions. Would there be any way that a listener could contact you or track you down?

Finney: Sometimes they will come to me through our national organization, AAIM. We actually have a kind of a mechanism at the national organization in which the secretary for it maintains a file of members like myself who are willing to have a one on one phone conversation with people about life insurance medicine. And what they try to do is they try to match the caller with the person already in the field. So, for instance, if somebody is a sub specialist. you know, I might take them on. Whereas other people who are in the field who are more in primary care originally, they might try to match them with that. Or sometimes they'll match them with people geographically or whatever. So these really aren't people that are designed to find you a job, but more somebody that you can relate to, you know, who has agreed to be a participant.

Jurica: Okay, so if they were to go to the website for AIM. they'd be able to find a contact form of some sort or trying to get linked up with someone who could answer some questions or mentor them.

Finney: Right. There's a secretariat who does all of our administrative work and she is well familiar with this program.

Jurica: Okay, good. Alright, well, I thank you again very much for joining us today. You've answered a lot of questions and given us a lot to think about if we're interested in this area. You did a great job and I'm going to be following up on some of this myself and mentioning it to some of my colleagues who might be interested

Finney: Sounds great.

Jurica: All right, Judy, thank you very much again and I guess then I'll just say goodbye for now.

Finney: Okay, goodbye John.

Sign up to receive email reminders, news, and free stuff every week!

Enter your name and email address below and I'll send you reminders each podcast episode, notices about nonclinical jobs, information about free and paid courses, and other curated information just for you.

Transcription PNC Podcast Episode 365

The Amazing Field of Life Insurance Medicine - A PNC Classic from 2018

- Interview with Dr. Judy Finney

Jurica: It's my pleasure to welcome Dr. Judy Finney to the PNC podcast. Hello, Dr. Finney.

Finney: Hello.

Jurica: Thanks for joining me today. This is going to be great because I've been trying to find someone to talk to about the life insurance industry and the physician positions in that industry since I heard about it about a year ago. And I came across an article by Heather Fork and I think she was quoting you in the article.

So I thought you would be perfect, a perfect person to answer the questions for our audience today.

Finney: Well, that sounds great. I met Heather at a conference for physicians who are contemplating career change called SEEK and so I have really run into her the last several years annually and we talk all the time about positions including in my field.

Jurica: That is just perfect because my audience is pretty much the same as the people that would tend to come to the SEEK conference. So let's just get into this then. Why don't you tell us first about what it is that you do in your position as a life insurance physician, if that's what I would call it, but you can explain that to us if you would.

Finney: Okay. Well, I'm employed by Allstate, which is actually a combined insurance company and it really does a lot of property and casualty, home and auto, but they always have had a certain portion of their business in life insurance. And in fact that end of the business is actually growing for Allstate.

So my boss was actually in his position, I think for about five or six years before he hired me as the second physician and we're now up to four physicians who work in the life insurance medical department at Allstate. And primarily what we do is in underwriting, which is basically a risk assessment of potential mortality for people that are applying for life insurance policies. There's other physician positions at other organizations that sometimes do a little more than that.

They might work in claims, which are things that need to be assessed after the fact of a death, or they might work in underwriting research and policy or writing reinsurance manuals, but at Allstate we don't necessarily do those functions. We are very concentrated in underwriting. So as my job basically involves a lot of communication with underwriters who are a professional group of people.

In Allstate, they usually number around 90 to 100 people scattered across the country who are doing sort of preliminary review of life insurance applications. And that review would actually include some non-medical things, but it also includes medical things. And so I serve, as do my fellow physicians, as resources for those underwriters.

They would tend to send us cases which are more difficult or more complex or have more medical problems instead of being very simple. They're pretty experienced, so they tend to be able to handle the simple ones themselves. But the more complex things get, the more they might need some medical review.

And especially if something was rare or unusual, or it took a lot of what I guess what I would call weighing and measuring, that would be the kind of case that would come to the medical director in the life insurance underwriting department at Allstate. And that case would involve their review. So they make an assessment of the medical records and send me their thought process plus the actual medical records themselves.

My job would be to review all of that and then I have various resources I can use in order to help judge mortality risk and I would send back an answer to that underwriter. So I would assess the risk, but I would also assess their evaluation. And thereby, case by case, I'm literally doing one-on-one education and training.

So I would say that portion of my job takes up about 50 to 60 percent of my time on a day-to-day basis. And about, I would say, 20 to 30 percent of my time is spent doing other things that are also educational, but they're not based on a single case. So for instance, I might give a webinar over the computer or through Skype or other sources in which I would teach about a specific topic.

Now, I happen to be a cardiologist, so I will tell you that they very often ask me to speak about cardiology topics, you know, and this might be hypertension or coronary disease or coronary calcium scores or the tiny important details in echocardiograms, but many times it's often in non-cardiology topics. For instance, multiple sclerosis or anemia or adult survivors of childhood cancer. Those are all topics that I've given various talks on in the past.

And then the smaller fraction of the rest of my day or my week would be to serve as a resource to other departments in the corporation. It might be the legal department or it might be the underwriting research and policy department or perhaps one of the executives in the c-suite who has a particular interest because they've read something in the Wall Street Journal or the New York Times and they want a medical assessment as to how this impacts our industry and specifically our corporation. So my job involves a lot of reading, answering, communicating, educating, that kind of thing, but it might differ as to who I'm doing it to and for and at what level of detail.

Jurica: Of those things that you're doing, are there certain parts that you find particularly satisfying or interesting?

Finney: Well, I actually like this job quite a bit. And what I would say is I always did like teaching, including when I was a clinician. So it didn't surprise me to have the teaching parts of this be very satisfying.

But I think I also was a person who really, a physician who really liked the puzzle, figuring out the puzzle. So to have cases that I'm thinking about, reviewing, and then doing what I mentioned before, the weighing and the measuring, in a lot of ways that whole function is part of being a clinician all the time. All the time you're taking in information and you're weighing risks and benefits and applying it to your own personal experience and your knowledge of the medical literature and trying to come to some conclusion.

So those are really transferable skill sets and that kind of thing is the same kind of function that you do. It's just that you do it from the lens of mortality risk assessment in various medical impairments.

Jurica: Very interesting. So it's clearly a non-clinical job, but like a lot of our non-clinical jobs that really, there's a lot of overlap with what you learn during your education and training as a cardiologist and interventional cardiologist and so forth. So that's good to know.

But maybe we can step back for a minute and you can explain sort of how did you make that transition and why from a practicing cardiologist?

Finney: Well, I'm not sure everybody should do it my way. Maybe that's one thing I should say from the start. I sort of did my transition in a more desperation mode and a setup to here mode and I don't always think that's really a really great way to make decisions.

It's just that it worked out for me. But you know trusting to luck may not be really the right way to handle it. I was actually one of those people that really truly loved my job, loved my field and if you really had asked either myself or anybody that knew me during all the years that I was in cardiology, which were quite a few, they would have told you that I probably would be one of those people that would die with my boots on still practicing.

And I would have told you that also. It's just that the last few years that I was in practice and I basically stopped doing clinical practice in September of 2012. I found like many physicians find is that they're really not in control of their destiny anymore and they also what they signed up for is not exactly what was happening.

And so it was I think a gradual transition over time and I did try to solve it in other ways. I had my own practice. I was in private practice and I created a group and I grew the group to a pretty good size and my first assessment of this was that I was simply burnt out from being both very administrative in my practice as well as clinically involved.

And I was just burning the candle at both ends. And so I thought I would solve it by getting out of my own practice and moving to another actually larger cardiology practice where I could devote myself to just being clinical. And I lasted in that for about three and a half years, but it sort of became clear to me that the same challenges that I faced in my practice, many of which I think were external to the practice, they were still affecting this other larger practice as well.

And so I sort of gradually came to the conclusion that it wasn't just me or just my circumstance, but it was a larger issue. And yet I felt that I didn't really want to just retire. I felt like I still had more to give and I really enjoyed using my brain and I just didn't want to work 100 to 110 or 20 hours a week.

I just felt like it was sort of unfair to ask me to do that. But I couldn't really find a good way in cardiology, in the city I was in with the circumstances that existed, to downsize. So that's when I became more open-minded to looking around to other things.

And I was still working at the time and I kept looking and looking and, you know, to be honest, feeling more and more desperate. So one of the ways that I looked is I actually asked a couple of friends that went all the way back to medical school who had made the transition to life insurance medicine years before. I asked both of them if they thought I could do that job and would I be good at it and would it be good for me?

And of course because they knew me, they could give me good honest assessments and they said, yes, this would be great. It would be great for the field and great for you, etc. And I had had one helpful experience, which was some five years before that I was asked to be a guest speaker on a cardiology topic at one of their regional meetings.

So I had met a whole bunch of people in life insurance medicine already and I didn't just stay for my own talk. I stayed for the entire meeting and I got a chance to meet, you know, 40, 50 people who were in the field and they were singularly happy. so it impressed me and I think it just kind of sat in the back of my brain.

I kept thinking, when's the last time I've been in a room full of happy doctors? And that's really why the idea of insurance medicine came. And then when it did, I contacted my friends and tried to sort it out.

Now I will tell you that I didn't, you know, despite making the decision that this was a good place to go into or to transition into, I still didn't get any interviews for probably six to eight months. And so I put my resume out. They tried to help me a little.

They told me some things I could do to prepare myself a little better and become sort of a better candidate. But because the people in the field are pretty happy, it's not like there is enormous turnover in the field. I think there will be some and I have spoken about this and written about it before.

It's because a lot of the people in the field are now in the age group where one would expect retirement. But there's also some changes that are happening in the field. Some companies are buying other companies.

So there's some contraction. And there is some automation of processes. So because of that, I'm not totally sure that what I anticipated five years ago about the number of retirements.

I'm not sure that that will really be exactly the same. It might be less.

Jurica: Okay.

Finney: I will tell you my experience is that most people who go into this enjoy it a lot. And so they don't really leave. And they don't necessarily leave voluntarily.

Or if they do, they just leave to go to another company and do the same thing. So that's one key sign that people are generally happy with the field, you know.

Jurica: Yeah, in my conversations with a few people I have spoken with, there's been a pretty much a consensus that most physicians in this field are happy with their careers and glad they made that choice. I want to go back for one second. You know, you're talking about how your colleagues or friends said, well, hey, you know, you'd probably be good at what we're doing.

Do you feel like there's certain traits that would be either favorable towards working in that sort of position or traits that would say, no, maybe something else would be better? Any ideas on that?

Finney: Yes, I think so. I mean, I get asked this question sometimes by physicians who come to me just like I went to my friends. And what I would say is that you have to understand that a great deal of this work involves reading and then typing back answers and communicating one-on-one with people.

So it's a production-oriented environment. And also in general, I would say the person who does this as a physician needs to understand that they are in a whole new environment, a corporate environment, in which the physician is not the so-called buck stops here final arbiter of many things, including individual case decisions. And that transition, I think, would be hard for some people.

When I first made the transition and I was working for a while in life insurance medicine, I kind of wondered to myself, out of all the cardiologists I knew, and maybe especially interventional cardiologists, how many did I know that I thought would actually be able to make a successful transition where they weren't the king of the ship anymore? And I think the number might be small. So I think it helps to be able to have a mindset that you're part of a team and you're a smaller cog in the really large wheel.

So what I would say is that's a quality that you would either have to have or develop. I think that you also should understand that you're only one piece of the puzzle. You are the medical piece.

You are the medical expert that people are consulting for your medical knowledge. But you are not the only person that is participating in this decision. Because this is a business and the business is to sell insurance policies.

So there always has to be some give and take on a lot of the non-medical factors that go into the decision of whether to extend an offer. So that's one thing. I would also say that most people don't understand that although they may know a lot about medicine, they probably don't know much about actuarial science.

And although you don't have to become an actuary, I think you have to. This is a very difficult field to make a sudden leap into from one day doing your clinician job to the next day suddenly going into this field and being able to do the kind of work you need to do and communicate with the people you need to communicate with if you don't have some background knowledge about insurance and actuaries and their vocabulary and how they do their calculations, etc. So I did not find that I had to become an actuary, but I had to learn how to think like one and I had to learn how they come up with some of the things that they come up with, etc.

So you can't do that in a day. And what I would say is because the jobs are fewer and because the competition is growing because the field is so pleasant, it's helpful to distinguish yourself by making some moves to get yourself a little bit more trained or familiar.

Jurica: Okay, so great segue. So your story is unique like everybody's, but now that you have this experience and you're looking back and people are coming to you, so what would be sort of the ideal way to prepare oneself and position oneself to be attractive to an employer?

Finney: Well, I think I will talk about some specific background for life insurance. But one thing I would say which people should understand is that it's very difficult to find a part-time job in this field. They almost all are full-time jobs.

But what you can do, I think, is develop what I call transferable skills. So there are many jobs that are in similar fields that have transferable skills and many more of those can be part-time. So that's one way somebody who's working as a clinician but wants to make a transition could kind of dip their toe in the water and just make absolutely certain they like what they're doing, they can perform, they can live within the parameters, that kind of thing.

For instance, people who do utilization review or quality assurance review in which you are given cases, you have to make assessments, you have to give written responses, you have to perform your duties within certain project time frames or turnaround time frames. Those are all things where you can demonstrate very similar skills and performance and see if you like how that goes, how that day goes, and see if it suits you. Those are fields that have many more part-time and project limited opportunities.

So you literally could sort of demonstrate your skills. So I often advise people to try to do something like that and put that right near the top of their resume when they're looking into life insurance because that's the kind of thing where people will sit up and pay attention and realize that you've gone the extra mile to try to train in the skill set. In terms of education, there is sort of a bible of life insurance medicine and although it's expensive, I think it's really worth purchasing if you're serious.

I got my bible through Amazon and so it's available. It's called Brackenridge's Medical Selection of Life Risks. It's this enormous textbook and the whole first half of the textbook is really demonstrating life insurance as a history, how it came about, and how people did the calculations and some real basic things about mortality and morbidity calculations, how actuaries think, terminology, and then the whole back half of the textbook is very disease and impairment specific.

So once you get the basics, how do you apply them to various disease states that we see? When we read medical records, so that's one thing. Another thing is there's a whole formal organization for medical directors, which is national, which is called AIM, A-A-I-M, American Academy of Insurance Medicine, and it is national.

There are some international people that come to it, but it is mainly intended for physicians in the United States who work for various insurance companies, primarily life insurance, but some disability insurance and some critical illness insurance. And so we have an annual meeting for AIM that happens every year. Most years are two and a half days long.

CME credits can be earned and then every third year is what we call our triennial meeting and that meeting is five days long. And once again, you can earn CME credits. There's a whole lot of people in the field from many, many companies who come to that so you can make contacts.

It is not limited to people that are already in the field. And usually at least 50 percent or more of our speakers are actual clinicians who practice at universities and come and give us updates in various medical fields. Because one of the things is you have to keep yourself updated in what's going on in clinical medicine in order to be able to read medical records and tell the importance of various things that you're reading.

So going to one of these national meetings, I think is very useful both for contacts and for information. We also have regional meetings that take place. For instance, this particular year, I'm the president of the Midwestern Medical Directors Association or MMDA.

And that is a regional association for life insurance companies that are generally in the Midwestern state. And we have a meeting every May and so there are probably 40 plus people who attend our meeting who are medical directors, but we also are open to people who aren't in the industry yet. And we usually have, I would say, anywhere from two to five people that are coming to our regional meeting and making contacts and seeing what kinds of educational opportunities we have, etc.

There's also a national underwriting association, which is you know really meant for underwriters, but they do an enormous amount of very basic training both online and with textbooks, etc. And they're called LOMA, L-O-M-A. And Life Office Management Association is what that stands for.

And they have a website www.loma.org So they also provide underwriting type training and if you're totally green and don't know anything about underwriting, they have some very basic courses that would be able to bring you up to speed and they're not terribly expensive, etc. Another very useful thing for people that are truly serious is that AIM has a specific basic mortality course that they advertise. And the course is very interesting and it pairs you with a mentor and takes you through some mortality calculations with homework over about a six-month period with feedback back and forth between you and the mentor.

And then it culminates in a one to two-day meeting, which is piggybacked on to one of the national or regional meetings where you can have a review and then take a test and get a certificate. So doing things like this in terms of reading, courses, meetings, and especially that basic mortality course, those are all ways that people could prepare themselves so that they look appealing to a hiring manager who is looking to hire somebody who's never been in the field before.

Jurica: Well, that's a lot of really good information and it would take someone hours and hours just to start looking into some of those things. I will provide show notes, links to the various organizations and so forth that you've mentioned. So that'll be fantastic.

I know the listeners are going to appreciate that. Sounds good. Now, let's see.

Any other thoughts or I guess one of the questions I had is whether there's some kind of newsletter or any kind of journal that is produced either from one of those organizations or just in general that addresses this topic?

Finney: We used to actually have a journal that was literally published, but now it is published electronically on the AIM website. So it's called JIM, J-I-M, Journal of Insurance Medicine, and comes out quarterly. And you can get at it through the AIM website and I'm sure I'll provide these things to you so that you can have links.

In general, you know, you have to be an AIM member, but people who are not yet in the insurance medicine industry can in fact become an AIM member just like they can through the MMDA that I mentioned.

Jurica: Awesome. That's great. Well, let's see.

We're getting close to the end here. I did want to circle back a little bit because you mentioned the SEEK meeting and I believe you're scheduled to speak again this year. I didn't know if you want to talk a little bit about that.

Finney: Sure. I think SEEK is a very useful thing for physicians considering transition to go to. I will tell you that I was unaware that they existed before I made my transition, but I wish I had known about them.

Because one of the things that astonished me the most the first time I went was how many fields are out there and how many non-clinical opportunities there are for physicians. It just was astonishing to me. So I really got invited to go there because a hospitalist that I knew provided my name to them as somebody in life insurance that he thought would be a good speaker for them.

So they called me. So that very first year I basically gave a 45-minute talk kind of like this all about life insurance medicine with some slides and talked about, you know, making the transition and what did it take and what was involved that kind of thing. So they have those kind of opportunities at SEEK where people in particular fields already come and talk about how they made their transition and what's involved in their field.

And usually attendees can pick and choose which one of these various talks they would like to go to according to their level of interest. But they also have an opportunity which I've also participated in now which is kind of called mentorship in which you sit at a table in a large ballroom and you do almost like a speed dating kind of experience in which people sign up to have little individual 15-minute visits with a person in a particular field and they talk back and forth about their own personal experience. They get to ask questions.

So you kind of have a one-on-one interview with people who are interested in your field. So I've done both the talks and the mentorship. I tend to create a handout for mine because it's really hard to cover everything in 15 minutes and because I think it's useful for people to have something they can walk away with.

Jurica: Very nice. No, I bet they really appreciate that and I have been to one of the meetings and it is an eye-opener the first time you go just to see so many people interested in change and so many different careers out there that you maybe hadn't even imagined. So I bet they're very happy to have someone such as yourself to be able to talk to the insurance industry because I know they like to have people that are pretty experienced and knowledgeable and can give some practical advice.

So that's very helpful. All right. Well, I think we're going to wrap it up then here. There might be some questions. Would there be any way that a listener could contact you or track you down?

Finney: Sometimes they will come to me through our national organization, AAIM. We actually have a kind of a mechanism at the national organization in which the secretary for it maintains a file of members like myself who are willing to have a one on one phone conversation with people about life insurance medicine. And what they try to do is they try to match the caller with the person already in the field. So, for instance, if somebody is a sub specialist. you know, I might take them on. Whereas other people who are in the field who are more in primary care originally, they might try to match them with that. Or sometimes they'll match them with people geographically or whatever. So these really aren't people that are designed to find you a job, but more somebody that you can relate to, you know, who has agreed to be a participant.

Jurica: Okay, so if they were to go to the website for AIM. they'd be able to find a contact form of some sort or trying to get linked up with someone who could answer some questions or mentor them.

Finney: Right. There's a secretariat who does all of our administrative work and she is well familiar with this program.

Jurica: Okay, good. Alright, well, I thank you again very much for joining us today. You've answered a lot of questions and given us a lot to think about if we're interested in this area. You did a great job and I'm going to be following up on some of this myself and mentioning it to some of my colleagues who might be interested

Finney: Sounds great.

Jurica: All right, Judy, thank you very much again and I guess then I'll just say goodbye for now.

Finney: Okay, goodbye John.

Sign up to receive email reminders, news, and free stuff every week!

Enter your name and email address below and I'll send you reminders each podcast episode, notices about nonclinical jobs, information about free and paid courses, and other curated information just for you.

Disclaimers:

Many of the links that I refer you to, and that you’ll find in the show notes, are affiliate links. That means that I receive a payment from the seller if you purchase the affiliate item using my link. Doing so has no effect on the price you are charged. And I only promote products and services that I believe are of high quality and will be useful to you, that I have personally used or am very familiar with.

The opinions expressed here are mine and my guest’s. While the information provided on the podcast is true and accurate to the best of my knowledge, there is no express or implied guarantee that using the methods discussed here will lead to success in your career, life, or business.

The information presented on this blog and related podcast is for entertainment and/or informational purposes only. I do not provide medical, legal, tax, or emotional advice. If you take action on the information provided on the blog or podcast, it is at your own risk. Always consult an attorney, accountant, career counselor, or other professional before making any major decisions about your career.

Leave A Comment

You must be logged in to post a comment.