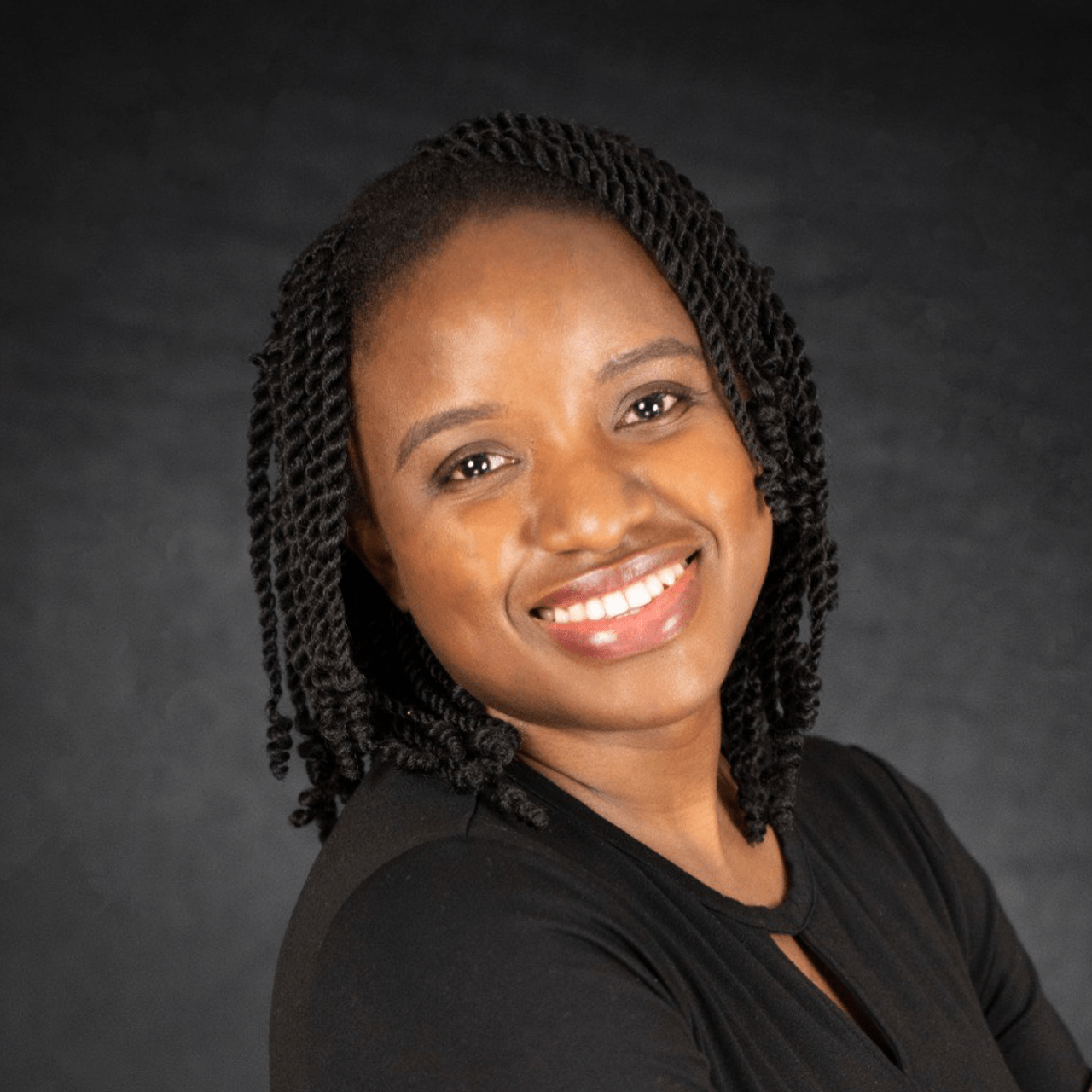

Interview with Dr. Chiagozie Fawole – 409

In this week's episode, Dr. Chiagozie Fawole explains why business ownership is better than real estate investing, based on her own experience with each.

As a pediatric anesthesiologist, Dr. Fawole explored real estate but found it capital-intensive and unpredictable. She later pivoted to acquiring established businesses with a steady income and built-in systems. This approach allowed her to build wealth while continuing clinical work.

Our Sponsor

We're proud to have the University of Tennessee Physician Executive MBA Program, offered by the Haslam College of Business, as the sponsor of this podcast.

The UT PEMBA is the longest-running, and most highly respected physician-only MBA in the country. It has over 700 graduates. And, the program only takes one year to complete.

By joining the UT Physician Executive MBA, you will develop the business and management skills you need to find a career you love. To learn more, contact Dr. Kate Atchley’s office at (865) 974-6526 or go to nonclinicalphysicians.com/physicianmba.

For Podcast Listeners

- John hosts a short Weekly Q&A Session on any topic related to physician careers and leadership. Each discussion is posted for you to review and apply. Sometimes, all it takes is one insight to take you to the next level of your career. Check out the Weekly Q&A and join us for only $5.00 a month.

- If you want access to dozens of lessons dedicated to nonclinical and unconventional clinical careers, you should join the Nonclinical Career Academy MemberClub. For a small monthly fee, you can access the Weekly Q&A Sessions AND as many lessons and courses as you wish. Click the link to check it out, and use the Coupon Code “FIRSTMONTHFIVE” to get your first month for only $5.00.

What to Look for When Buying a Business

Dr. Fawole shares how she evaluates businesses based on strong revenue, solid profit margins, and operational history—typically favoring companies that have been around for at least ten years, bring in over a million annually, and have ten or more employees. She explains why these factors help avoid the pitfalls of startups or family-run operations and how physicians can step into businesses that are already running well. Instead of building from the ground up, she outlines how buying the right business can provide dependable cash flow using smart financing that doesn’t require heavy upfront capital.

Business Ownership Is Better

For physicians looking to dip their toes into entrepreneurship, Dr. Fawole suggests starting with short-term rentals. She describes this as a low-risk way to learn negotiation, operations, and tax strategies while keeping a steady clinical job. Over time, these experiences build the confidence and know-how needed to move into bigger business opportunities with greater income potential and personal freedom.

Summary

To learn more, visit savvydocevents.com, where Dr. Fawole shares a free checklist for evaluating businesses at savvydocevents.com/5things. She’s also active on LinkedIn and Facebook. Her upcoming Catalyst Business Acquisition Bootcamp will be held on September 12th–14th in Syracuse, New York. It's an intensive weekend program that walks participants through how to find, buy, and grow a business.

Links for today's episode:

- Dr. Chiagozie Fawole's Website: Savvy Docs

- Dr. Chiagozie Fawole's Detailed Checklist of Business Evaluation Criteria

- Dr. Chiagozie Fawole's Upcoming Catalyst Bootcamp September 12th-14th

- Dr. Chiagozie Fawole's Facebook

- Manage Your Practice Like a Valuable Business Asset

- How to Prepare to Sell Your Growing Healthcare Business

- Apply Discovery, Innovation, Value, and Execution to Launch Your Business – 319

- Want to Buy Your Own Senior Care Business? – 314

- How to Improve Your New Business Odds of Success by Buying a Franchise- 292

- Revisiting How to Use Real Estate Investing to Go from Burnout to Financial Freedom – 307

- How to Integrate Real Estate into Your Investing or Career Pivot – 295

- How to Use Real Estate Investing to Go from Burnout to Financial Freedom – 229

- How to Build a Thriving Real Estate Passion Project Without Being a Landlord – 193

- Why Should I Invest in a Passive Private Real Estate Deal? – 154

- The Nonclinical Career Academy

Download This Episode:

Right Click Here and “Save As” to download this podcast episode to your computer.

Podcast Editing & Production Services are provided by Oscar Hamilton

Transcription PNC Podcast Episode 409

Why Business Ownership Is Better Than Real Estate Investing

with Dr. Chiagozie Fawole

John: One of the best ways to build wealth and financial freedom is to become an owner and investor rather than an employee. I think most of us know that already. So I'm excited about today's guest who will explain how she employs both real estate investing and business ownership to achieve financial independence. So Dr. Chiagozie Fawole, thank you for being here today. Hello.

Dr. Chiagozie Fawole: Thank you so much for having me on Dr. Jurica. I am very excited about it.

John: I am very excited about it too because I've spent the last couple of days watching a bunch of videos with you and your guests and some other things. The more things I listen to, you know, a lot of it's about mindset and it's when someone's like positive and being really, you know, enthusiastic, it wears off. So that's... I was even listening to some related podcasts today. But anyway, let's skip that. Tell us about yourself briefly and I guess kind of segue into where how you got from being a physician, which you still are obviously, into real estate.

Dr. Chiagozie Fawole: Yeah. So yeah, thanks for having me on actually. So I'm Chiagozie Fawole, like you said, I am a pediatric anesthesiologist based in the Syracuse area, mom of three kids, business owner now. How did it start for me? So I was born and raised in Nigeria, came to United States at about age 16, Howard University, Johns Hopkins, you know, did the whole med school route. But it was during residency actually, while we were in Brooklyn, New York, I was at... I had this itch because I noticed, and no shade to anyone, but I noticed that we had attendings, because at the time our attendings were like bias dinner on call. And I noticed that there were some attendings that were like, oh, you know, we'll just buy anything you want. Like, what do you want? We'll buy it. And then there were other attendings who were like, you get $10 and you get $20. And I was like, that was a huge... I was like, so clearly it means that just becoming an attending doesn't necessarily equal having a ton of money. At least it seemed that way.

And it created this sort of hunger or itch or quest in my mind that, okay, what is it that these ones are doing that they have all the money? Like there has to be something else you can do to boost your wealth, to grow wealth. And I began searching for the other thing. And then I was watching TV one day, watching Flip or Flop with Tarek and Christina on HGTV. And I saw them do a flip, a real estate flip, and they made $60,000. And my eyes were like googly-eyed, like, wait, what? Cause at the time we made about $54,000. Oh, I made 84k as a resident. So these guys just made my entire annual salary in one deal, no call, no missing kids event, all of that. And I was like, whatever they're doing, I need to go learn it. So I went down this huge rabbit hole of real estate and eventually got my first deal done and subsequent deals. And we can talk a little more about that, but that was the beginning.

John: Yeah, I've seen that show several times and the other shows that they had. I get the sense that there's a lot of that happens in the background. It may not be as easy as I'm sure you found that out if you've done real estate.

Dr. Chiagozie Fawole: Oh I sure did.

John: But still, it's a thing and it could be very productive and, you know, financially excellent. So let's see, though. Tell us a little bit then about the type of real estate, because I've had some guests on doing real estate and it just varies like so many different options. And so what have you come up with as sort of the best options for you?

Dr. Chiagozie Fawole: Yeah. So I chuckle because it's almost like if it exists, I've probably thought about it and maybe taken a stab at it. But the first deal that we did was actually a flip, just like on TV. And we found a deal all the way down in Norfolk, Virginia from Brooklyn, New York. I was able to, you know, organized the deal and then my dad was the boots on the ground person because they live about 30 minutes from it or so. Turns out that one did not work out like on TV as you as you anticipated, right?

John: Oops.

Dr. Chiagozie Fawole: Actually we lost 10K on that deal. After that one, it was like, OK, well, that may be a little risky. What else can I do? Now at this point, I was knee deep into the real estate forums online and I heard of, you know, multifamily. I'm like, OK, great. Well, the kicker here was I didn't have money to start. OK. So I figured out, you know what? I don't have money, so I might as well get a deal that's big enough that I could bring other people in and have a cut for myself. So I ended up doing a 12 unit apartment complex, got about five other investor parties, and we basically split the deal. It ended up being roughly one sixth a person or an investor group. So we ended up owning about 16% of that deal, but they brought all the money.

John: Got it.

Dr. Chiagozie Fawole: I ran the deal on the back end that was multifamily. Now at that time I thought, you know what, let's go get 2000 units. You know how they talk on the, on the internet. I'm like, let's go get, you know, 2000 units and blah. And my husband goes, actually, no, he did not want to have to, you know, have the burden of people's money and all of that. And he's like, can we, can we just do just like what we're able to do by ourselves? Like, let's not add that extra stress to, and I'm like, okay, fine. Because between the two of us, I tend to be a little more of the like, go, go, go. And he's more of the like the safety, you know, like the...

John: That's a good match up.

Dr. Chiagozie Fawole: It's a perfect match up between the two of us. And so when we moved to Syracuse, so those first two deals actually happened while I was still a resident and now going through my one year fellowship for Peds Anesthesia. So by the time I finished my fellowship, we moved to Syracuse. Within the first three months of being an attending, we actually ended up having a major life event. I had a preemie born at 25 weeks during that period, but we ended up buying our first two duplexes in December that year. So our motto when we came to Syracuse was more of let's just buy small multifamily properties using what's called the BRRRR strategy where you buy property, rehab or renovate them, refinance and basically take the cash out and do it all over and over again.

And that was our way of using, you know, a pile of cash that we got in that, in those first few months and basically just recycling and building our portfolio. So we did that for the next, so that was 2017, did that until 2020. 2020, we bought our, what was our last multifamily property just as the pandemic was starting. But at this point now I was helping other doctors get started and I could, each time I got on sales calls with people, they were telling me of how they wanted to like leave medicine. Like yesterday they needed something that could give them cashflow. And I'm like, okay, well it's not what I'm doing because this takes time, but I'm like, but there has to be something.

And that was when I found this thing called rental arbitrage, which is where you lease a property and turn it into a short-term rental. Yeah. And in a three month window, I was able to get 10 apartments and turn them into short-term rentals. And at that point I was like, anyone who had an ear had to hear about rental arbitrage, because I was like, previously you were limited by how much capital you had, but now with just, you know, $7,000 or even $4,000, you could be into a unit that will create 1K a month. Do that a couple of times. And so I hosted a conference for short-term rentals at the time. It was called the short-term revolution podcast. And I was so excited about it. We got about 1500 doctors roughly to attend virtually at the time. And because at the time people were just starting to like do short term rentals, but it was almost like this like silent thing that was happening that you could just see people getting to short term rentals and not talking about it. But then they were making like crazy amounts. And as I interviewed people, it was like, wait, what? You guys are here making 150K per property and not talking about this. Like, what is...

John: OK, pause there for one minute. I just want to make sure it's clear to some of the listeners that maybe haven't at least dabbled or looked at this. So you're basically, let's say leasing or renting the property at like a standard rate, thousand, two thousand a month or whatever. But because you do the short term rental, you're charging... What would the amount be? Five, ten times that amount?

Dr. Chiagozie Fawole: It was usually about two or three times at the time. Just enough to get you a good enough...

John: Yeah, healthy. That's quite a bit. I know you have downtime in between, so there's gaps. It's not like short-term rental is gonna be for a year. So you have to fill those gaps in as many as you can. Okay, so I just wanna make sure listeners understood. I mean, when I heard about that, that sounded like, wow, that is awesome if you can do it. I never tried it, but it sounded awesome.

Dr. Chiagozie Fawole: Yeah, it was actually pretty crazy. But then what then happened in the subsequent years was that rents began to go up and it became a lot harder to find where those numbers worked. But while I was interviewing the doctors and professionals for that conference and I was hearing their numbers, people were talking about buying property for 600,000 and then making 150 in revenue. I was like, wait, what exactly? But then I had ruled myself out of being able to buy short-term rentals then because I thought they were too expensive. But it was during that conference that I learned of the financing options that you could finance them at 10% down instead of 25% that I thought you had to do for investment property. So once that key was unlocked for me, within the next two months, we bought our first lake house and that marked the true, it marked our pivot into actually just buying. And so we started buying luxury lakefront property. And from a real estate standpoint, that's sort where we have now sat for the last three, four-ish years now.

John: OK that's a little busy you've done a lot in a few years. So are you now, do you still look for new opportunities there? Are you kind of satisfied with what you have? And then maybe you can tell us just how many you have or what they look like, something like that.

Dr. Chiagozie Fawole: So about two years ago, we were thinking of ramping up and ended up buying five properties in a very short timeframe. Most of them needed some work. And I thought, you know what, I've done renovations before, because our model really has involved renovating houses for the last, I mean, since we began, really. But it ended up being actually more challenging from basically every angle. Like at some point, the city shut us down for one of the properties. At some point, you know, one of them went over budget and ran out of cash. It was just very interesting. But at some point it began to stabilize and it was really, it ended up being really a journey of both faith and tenacity and, you know, just going through the motions and, but during all of this time, the idea of buying a business sort of began coming up. Okay. So it was now a case of like, okay, you don't need to, break yourself buying property. What if you just stabilize the one, actually like get through this hurdle, but while you're doing that, start to look for businesses.

And that was sort of how that transition, not really transition, or at least mindset thing began to transition. Because one thing that I found is that I love real estate. I love taking a house from, you know, ugly to pretty. But one thing I learned was that you need to have capital, not just available, but also in reserves. And after 10 years, you will think I would have known this already, this like having done this now with like multiple at one time, I realized, okay, don't do this to yourself. Like just take it easy, get your cash printing machine, which is a business of some sort. And then you can rehab to your heart's content. And that was when, you know, I mean, at that point I was, I was already, I had been building my coaching business for a while. So I knew that business has made money. But when all of these happened, it really just solidified in my mind that, okay, maybe the focus right now should really not just be on acquiring the property, but on acquiring something that then is that cash printing machine that then can fund the fun projects of renovating and doing the short-term rental thing.

John: Yeah, I mean, and they're probably... I mean, there's an infinite number of businesses that would tie to real estate. I'm assuming I could think of many, but, like my sister worked for someone who was a jeweler and she owned the jewelry business and she owned the building. And then she retired. My sister ran it for her and she was, you know, getting her percentage. He was good. Plus the rental on the building by the business. And so then, okay. So that sounds very intriguing. And I think people are going, oh, so how are they, how did you approach this and what direction were you going once that aha moment came?

Dr. Chiagozie Fawole: How happened? Yeah. So the first time the idea of even looking into businesses came to me was an online event that I attended back in 2020. But at the time it kind of seemed like, Oh my gosh, this is a really cute idea. But it didn't see like, it's almost like I didn't see it as something for me. It seemed like something for them. Like I'm in this room with these people buying businesses. I remember I even signed up for the guys course at the time. And I remember being in those rooms and just feeling like everything was like above my head. Like it felt like just this huge concept that will be nice one day, but I hadn't embodied that identity yet. It took about two years. It was in 2022. I then went to a different conference or event. And while I was sitting there, and talking to the people, actually, I remember it was on Sunday morning, I sat next to this lady who had actually just bought her first business.

And I was talking to her regular, you know, good old American woman with two kids, single mom, you know what I'm saying? Like very regular human being talking about the business that she acquired with no money down, that made 30K in the first month profit. And I'm listening to her like, this is flesh and blood. She's a human.

John: Sounds too good to be true, but let's see what happens.

Dr. Chiagozie Fawole: And just talking to her just unlocked something for me that, okay, like she can do it. I can do it. And so I, then I left that conference. Oh, and sorry, that same event. I also saw the numbers. I'm, that was when my eyes popped. When I saw the numbers and I sat next to the lady, was like, okay, we're doing this. This is it. I left that conference and on my way back, I mapped out my goals and vision or whatever. And within the next few months, I actually found a business that I wanted to buy. It looked great. The numbers looked great. It was a landscaping company in Maryland. It had, you know, like 18 or so employees. It was making the numbers that I would like. Before debt service, it was going to make me $425,000 a year. Yeah. Before debt service. After debt service, maybe take away about $180,000, maybe $200,000 from that. So I'd have walked away with maybe roughly $250,000 right there about. For a business that I would have bought for one point, I think it was 1.1 million. So 10% down on that would have been about 110 roughly. And it was great.

But then during due diligence, something came up and I was like, Oh my gosh, this seems so little to drop it. But then when I spoke with, I just happened to just be on a call with the guy that actually hosted that event I went for. And I was like, Oh, by the way, like the attorney and accountant are saying that this may be a no-go. He was like, tell me about it. And I told him, I was like, oh yeah, next one. I was like, what? What? Oh my gosh. That actually devastated me. Just like not devastated, like, you know, being all dramatic, but it almost felt like, oh my goodness. If I had simply called him before I sank all my money into due diligence, we could have known this before I spent $28,000 on due diligence. So for the next few months, just kind of like, took a step back, just like mentally recuperating from the deal, because I really liked that deal. And then I began my search again, I would say kind of towards the, actually the next year. Was it next year? No, no, no. In a few months, I began a new search with a new mentor and whatnot. But that was the first one. And then now we have another one that's also, because the mental part of all of it, but the numbers, once you see them, it's really hard to unsee.

John: Well, you know, it reminds me, I think the listeners know that my wife owned a business and she recently sold it. And we were... I mean, we were so open with all of our numbers. There was nothing hidden. So I think the buyer really felt good about it. But then there's a couple of things. I mean, I read through things my wife did the, you know, the offer and then the contract. But darn if my attorney didn't find one or two things that said this should not be in here. Now we were able to get rid of those things that at end of the day, you know, she was able to go ahead and sell. But I could see as a buyer having that same kind of, okay, there's something in here that could explode on me in a year from now or something, you know? And so you've just got to listen to those experts.

Dr. Chiagozie Fawole: You know, yeah, I learned that one because it was like. In my mind, it seemed like a very small thing. It was like a contractor versus employee designation. And I thought, oh, I mean, they're landscapers. They're probably all 10-99. It'll be okay. And I remember I even put it on a Facebook group. Like, is this a real issue? And people came out and they said, actually, Maryland tax collection makes the IRS look like puppies.

John: Okay

Dr. Chiagozie Fawole: And I was like OH.

John: And each state is different, right? in terms of what people have and the different rules or regs you may not be aware of if you live in a different state. All right. So take us on your journey then. Where are we now in terms of your learning as you go here? So you have an idea now, like kind of what's the ideal business for you or for people in general?

Dr. Chiagozie Fawole: Yeah. So initially I was looking for a home services business, and we're talking landscaping, pool companies, all of that, to kind of tie into my real estate background. But then at some point I shifted more so from the industries, now more so to just the numbers. And again, depending on who you're talking with at the time, those numbers will vary. But right now my buy box is that the business has to make more than a million dollars in revenue. And we have a cheat sheet for this, how your listeners can get afterwards.

John: Yeah. In the show notes.

Dr. Chiagozie Fawole: So it has to make at least a million dollars in revenue. And the reason for that is that for the most part, when, you're going to do this, you might as well get something that by the time you get it, it actually means something to you. So a million in revenue sort of like starting is like the business is, is like settled. Okay, because people don't just make a million still trying to figure things out. So at least a million at a minimum and then profit margins of 20% and above actually is more of 25 and up. Now, this is the one that I really use really often and that is 10 employees or more. And that is because, you know, for some people, for some business owners, it's them, their spouse, their, you know, son-in-law, brother-in-law, you know, family members, people that if you pay, they will all get a portion of that payout and could possibly leave. So you don't want to buy the business and then be left with just two people to work the business. Meanwhile, you've paid full enterprise value for a business that had about 10 people, you know, eight or even five people prior. So 10 is our cutoff. Now, will I look at a nine person business? Possibly, if the numbers are good enough, but... but really it's 10.

And then age of the business. So 10 or more years in business or more. So that way when we're not dealing with startups, they say how many percent of businesses go out of business in the first five years. So you don't want it to be that they are in the middle of their throws and then trying to sell the business and dump the business with someone and you now pick it up thinking it was all great. It's actually not that...

John: I've heard another, you know, it's like a similar strategy is there's a lot of people have started businesses 20 years ago and they're they want to get out. Now, they may have a 20 million dollar business you can't afford, but anyway, there's people in all kinds of businesses that are looking to get out. And some of them just want someone that they can trust to keep it going. They don't necessarily have to pay top dollar. It kind of sounds like you're looking at the same kind of thing.

Dr. Chiagozie Fawole: Yeah. Exactly. Yeah, because sometimes people ask me, but why would anybody sell a profitable business? It's like there are multiple reasons. They're tired, they're retiring. You know, some of them it's divorce, some of them it's they just want to move on. There are multiple reasons that people sell, but your job is irretrievable of what they tell you to actually go under the cover, raise the hood and take a look. And that's a due diligence piece that we're talking about.

John: Now, you mentioned it, I think, as you were talking about this, that sometimes they're just getting worn out and they can keep a business going for 10 years, maybe without following the best practices. They get in habits and they do things the old way. They don't even know about technology. I imagine coming in and using technology to streamline things. Makes a lot of sense.

Dr. Chiagozie Fawole: Yeah. So even as we look, that's one thing that we try to see that are there any inefficiencies right now that we could possibly add. For some businesses, when they come all dolled up, like if they're completely stabilized, you'll probably be paying a pretty high multiple for them because they know that they are good. But if you get them at a point where they're okay, they're profitable, they are functioning, but they have a couple of loose ends here that could be tied up, that could be an opportunity. Certainly what we look for as we search for them right now.

John: All right, do you have any out there you've looked at recently that fit in there? Because again, you're focusing on the financials. And is the business, the nature of the business all over the place or is it kind of down to a set type of business?

Dr. Chiagozie Fawole: Right now, I think my husband has successfully weaned me off the landscaping hype. I really wanted a landscaping company because in my mind, if I needed to do my backyard, why not just buy the company and then do the backyard? Because otherwise it would cost me $100,000. But now I've been weaned off that. I still like the home services space if the numbers work. I'm still looking at, I found a plumbing or HVAC company right now, I would happily take a look at that. I've come to also like equipment rentals because the few that I have looked at have been pretty solid. And actually right now we are looking at one like very seriously. But it's really, when it's not been real estate, it's kind of been in that heavy equipment zone. Also because those equipment companies tend to have a lot of equipment which will give you nice tax deductions on the back end.

John: This has been awesome. Okay, let's pause here because I need to do a promo for you in a way. Just because I actually listened to a bunch of lectures the other day that you produced in whatever was webinars with a bunch of different guests and I don't know if that's still available to people but Let's start with your website. Where can they find you and learn all about you?

Dr. Chiagozie Fawole: Yeah, so so primarily right right now if you go to savvydocevents.com that will be the first kind of window into our world. Yeah, but a very nice way would be even to just to grab that. Grab that cheat sheet of the five things to look for in a in a business you want to acquire and that will be savvydocevents.com/5things— number five.

John: OK, got it. Five things up with that in the show notes. And the website, of course. And then you don't mind the occasional inquiry on LinkedIn.

Dr. Chiagozie Fawole: Absolutely.

John: You can ignore those if you want.

Dr. Chiagozie Fawole: People reach out to me from LinkedIn, Facebook. I'm usually more on Facebook, but I do get LinkedIn notifications on my phone as well. But for those who want to just kind of see all the things that I post, it's probably going to be on Facebook to find me.

John: OK, excellent. OK, let's go back to what we were talking about. So let's just wrap it up in some way this way. So now with all the experience you've had, you're working on something right now. If someone was, let's say five, 10 years out of residency, they're half burned out. Now maybe they've paid all their loans off. They've got some money put aside. Maybe that isn't necessarily in a 401k or something. And they're thinking, yeah, I think I do want to maybe pursue something entrepreneurially. What would you tell them to start? Not really knowing what their interests are, you know, real estate business, something else.

Dr. Chiagozie Fawole: No, I would recommend that they buy one short-term rental because I truly believe that every doctor needs, I say every doctor needs a Doris because Doris was our first lake house. The reason is if you've never done anything entrepreneurial, it's like entrepreneurship on training wheels. You'll get the experience of going through a transaction, of negotiating, of actually getting it closed. The experience of having a place that you can actually get away to, you and your family, right? And you can also lock in some pretty hefty tax benefits by getting a short-term rental, not just any kind of rental, but a short-term rental that can possibly offset your W-2 income. But while you're doing that, then learning about buying a business, I think, will be the next move. And the reason that I put it that way is because, at least even with my clients to like redo a 90 day sprint and people can have a property in 90 days. So literally between now and what's, you know, now and July or now in August or whatever, you know, his gets, this gets released 90 days from now, you can start from absolute zero and be collecting bookings from your guests in a short term rental. So that can be done like that.

And then you can start learning about, you know, acquisitions and all those things, which it can happen quickly or it may take a little while, but at least you've begun to of grease those wheels of entrepreneurship, starting to sort of build the identity, because that's a huge piece of it too, the mental reworking of being a physician and entrepreneur. It's a whole mindset shift that happens. You start to kind of find yourself in circles asking questions that are nonclinical, making money that is not tied to being on call or being at work. It's a very good thing.

John: I think that's great advice. And then I think, you know, if you feel like you enjoy that, the idea of buying an existing business, having, you know, gone through starting one from scratch, albeit it's a, it's a franchise, so it helps the startup, but you know, there's eight, 10 years of, you know, struggling and then. She sold it after 16, so it worked out fine. But I like the idea of really focusing at some point if you have any interest in being an entrepreneur on the small business or medium business even. Let's see, I don't know if we touched on too, I was going to just say, what is Savvy Docs looking for in the future? And I think you did mention before we got out that you have some event coming up, which is probably not being promoted yet, but tell us about it people will listen to this four months from now.

Dr. Chiagozie Fawole: Absolutely. So you know how I mentioned that I went for a live in-person event? in 2022. Well, in December, I hosted a virtual event and people were asking me, there a course for this? And I was like, well, I don't have a course. But then I reached out to my mentor and I said, Hey, you want to teach something? And he agreed. So we actually hosted two iterations of this and people went through it. They loved it. But then I said, you know how I went for that event in 2022. Can we do it again? Can we do something like that for our people? And he agreed. So September 12th through the 14th, up here in Syracuse, New York, we will be hosting what's called Catalyst, a business acquisition bootcamp to help people get started.

And the idea is you come in one weekend, Friday, Saturday, and then finish up on Sunday. But one weekend, you will learn how to pick an industry, pick an niche, pick whatever, how to find good businesses, how to screen them, like I just told you. how to actually find them, like the actual mechanics of finding them, how to fund them. So both creative financing, deal structuring, different, you know, nuanced things that you can do with transactions, and then how to grow and scale them. So Mike, my business partner, he has bought over 50 businesses at this point. He's done over 50 deals. His current portfolio generates about $145 million annually. So he's done this quite a bit. And he's going to be teaching how he grows businesses. So his primary model is that he buys them, he grows them, and then he sells them. And he actually says, he's like, it's not the million dollars that you make annually from these businesses that really matters. It's more so what happens on the sales.

So he teaches how to grow them when you have them, using AI, automations, all of those things. And then how to prepare yourself for an exit. So it's not... I say like, it's not a fluffy event, okay? Cause he doesn't have to be there, right? I'm the one that called him. I'm the one that said, can you come teach our people? So he's like, yeah, it has to be to the point where somebody can come in and they learn what they need to know to be able to go out and go get deals done. And so yeah, September 12th through 14th up here in Syracuse, New York. And it's, if you want to check it out, it's savvydocevents.com/catalystlive. So C-A-T-A-L-I-S-T-L-I-V-E.

John: All right. That is going to be something to look forward to. And I'll definitely send a reminder out closer to, you know, it'll be in the podcast show notes for sure. But then down the road a few months, I'll maybe throw out a few more reminders to people. Maybe I'll show up with my wife.

Dr. Chiagozie Fawole: Hey!

John: That can be fun. All right. I think we're about out of time here. I want to let you get back to the rest of your life and your weekend. And it's already the weekend for you because you're an hour early than we are here in the Midwest. So, all right. I mean, I appreciate you coming on today. This has been really fun and I've learned a lot myself and we'll maybe keep in touch. Again, thanks for being here.

Dr. Chiagozie Fawole: Thanks for having me.

John: It's been my pleasure. Bye bye.

Sign up to receive email reminders, news, and free stuff every week!

Enter your name and email address below and I'll send you reminders each podcast episode, notices about nonclinical jobs, information about free and paid courses, and other curated information just for you.

Transcription PNC Podcast Episode 409

Why Business Ownership Is Better Than Real Estate Investing

with Dr. Chiagozie Fawole

John: One of the best ways to build wealth and financial freedom is to become an owner and investor rather than an employee. I think most of us know that already. So I'm excited about today's guest who will explain how she employs both real estate investing and business ownership to achieve financial independence. So Dr. Chiagozie Fawole, thank you for being here today. Hello.

Dr. Chiagozie Fawole: Thank you so much for having me on Dr. Jurica. I am very excited about it.

John: I am very excited about it too because I've spent the last couple of days watching a bunch of videos with you and your guests and some other things. The more things I listen to, you know, a lot of it's about mindset and it's when someone's like positive and being really, you know, enthusiastic, it wears off. So that's... I was even listening to some related podcasts today. But anyway, let's skip that. Tell us about yourself briefly and I guess kind of segue into where how you got from being a physician, which you still are obviously, into real estate.

Dr. Chiagozie Fawole: Yeah. So yeah, thanks for having me on actually. So I'm Chiagozie Fawole, like you said, I am a pediatric anesthesiologist based in the Syracuse area, mom of three kids, business owner now. How did it start for me? So I was born and raised in Nigeria, came to United States at about age 16, Howard University, Johns Hopkins, you know, did the whole med school route. But it was during residency actually, while we were in Brooklyn, New York, I was at... I had this itch because I noticed, and no shade to anyone, but I noticed that we had attendings, because at the time our attendings were like bias dinner on call. And I noticed that there were some attendings that were like, oh, you know, we'll just buy anything you want. Like, what do you want? We'll buy it. And then there were other attendings who were like, you get $10 and you get $20. And I was like, that was a huge... I was like, so clearly it means that just becoming an attending doesn't necessarily equal having a ton of money. At least it seemed that way.

And it created this sort of hunger or itch or quest in my mind that, okay, what is it that these ones are doing that they have all the money? Like there has to be something else you can do to boost your wealth, to grow wealth. And I began searching for the other thing. And then I was watching TV one day, watching Flip or Flop with Tarek and Christina on HGTV. And I saw them do a flip, a real estate flip, and they made $60,000. And my eyes were like googly-eyed, like, wait, what? Cause at the time we made about $54,000. Oh, I made 84k as a resident. So these guys just made my entire annual salary in one deal, no call, no missing kids event, all of that. And I was like, whatever they're doing, I need to go learn it. So I went down this huge rabbit hole of real estate and eventually got my first deal done and subsequent deals. And we can talk a little more about that, but that was the beginning.

John: Yeah, I've seen that show several times and the other shows that they had. I get the sense that there's a lot of that happens in the background. It may not be as easy as I'm sure you found that out if you've done real estate.

Dr. Chiagozie Fawole: Oh I sure did.

John: But still, it's a thing and it could be very productive and, you know, financially excellent. So let's see, though. Tell us a little bit then about the type of real estate, because I've had some guests on doing real estate and it just varies like so many different options. And so what have you come up with as sort of the best options for you?

Dr. Chiagozie Fawole: Yeah. So I chuckle because it's almost like if it exists, I've probably thought about it and maybe taken a stab at it. But the first deal that we did was actually a flip, just like on TV. And we found a deal all the way down in Norfolk, Virginia from Brooklyn, New York. I was able to, you know, organized the deal and then my dad was the boots on the ground person because they live about 30 minutes from it or so. Turns out that one did not work out like on TV as you as you anticipated, right?

John: Oops.

Dr. Chiagozie Fawole: Actually we lost 10K on that deal. After that one, it was like, OK, well, that may be a little risky. What else can I do? Now at this point, I was knee deep into the real estate forums online and I heard of, you know, multifamily. I'm like, OK, great. Well, the kicker here was I didn't have money to start. OK. So I figured out, you know what? I don't have money, so I might as well get a deal that's big enough that I could bring other people in and have a cut for myself. So I ended up doing a 12 unit apartment complex, got about five other investor parties, and we basically split the deal. It ended up being roughly one sixth a person or an investor group. So we ended up owning about 16% of that deal, but they brought all the money.

John: Got it.

Dr. Chiagozie Fawole: I ran the deal on the back end that was multifamily. Now at that time I thought, you know what, let's go get 2000 units. You know how they talk on the, on the internet. I'm like, let's go get, you know, 2000 units and blah. And my husband goes, actually, no, he did not want to have to, you know, have the burden of people's money and all of that. And he's like, can we, can we just do just like what we're able to do by ourselves? Like, let's not add that extra stress to, and I'm like, okay, fine. Because between the two of us, I tend to be a little more of the like, go, go, go. And he's more of the like the safety, you know, like the...

John: That's a good match up.

Dr. Chiagozie Fawole: It's a perfect match up between the two of us. And so when we moved to Syracuse, so those first two deals actually happened while I was still a resident and now going through my one year fellowship for Peds Anesthesia. So by the time I finished my fellowship, we moved to Syracuse. Within the first three months of being an attending, we actually ended up having a major life event. I had a preemie born at 25 weeks during that period, but we ended up buying our first two duplexes in December that year. So our motto when we came to Syracuse was more of let's just buy small multifamily properties using what's called the BRRRR strategy where you buy property, rehab or renovate them, refinance and basically take the cash out and do it all over and over again.

And that was our way of using, you know, a pile of cash that we got in that, in those first few months and basically just recycling and building our portfolio. So we did that for the next, so that was 2017, did that until 2020. 2020, we bought our, what was our last multifamily property just as the pandemic was starting. But at this point now I was helping other doctors get started and I could, each time I got on sales calls with people, they were telling me of how they wanted to like leave medicine. Like yesterday they needed something that could give them cashflow. And I'm like, okay, well it's not what I'm doing because this takes time, but I'm like, but there has to be something.

And that was when I found this thing called rental arbitrage, which is where you lease a property and turn it into a short-term rental. Yeah. And in a three month window, I was able to get 10 apartments and turn them into short-term rentals. And at that point I was like, anyone who had an ear had to hear about rental arbitrage, because I was like, previously you were limited by how much capital you had, but now with just, you know, $7,000 or even $4,000, you could be into a unit that will create 1K a month. Do that a couple of times. And so I hosted a conference for short-term rentals at the time. It was called the short-term revolution podcast. And I was so excited about it. We got about 1500 doctors roughly to attend virtually at the time. And because at the time people were just starting to like do short term rentals, but it was almost like this like silent thing that was happening that you could just see people getting to short term rentals and not talking about it. But then they were making like crazy amounts. And as I interviewed people, it was like, wait, what? You guys are here making 150K per property and not talking about this. Like, what is...

John: OK, pause there for one minute. I just want to make sure it's clear to some of the listeners that maybe haven't at least dabbled or looked at this. So you're basically, let's say leasing or renting the property at like a standard rate, thousand, two thousand a month or whatever. But because you do the short term rental, you're charging... What would the amount be? Five, ten times that amount?

Dr. Chiagozie Fawole: It was usually about two or three times at the time. Just enough to get you a good enough...

John: Yeah, healthy. That's quite a bit. I know you have downtime in between, so there's gaps. It's not like short-term rental is gonna be for a year. So you have to fill those gaps in as many as you can. Okay, so I just wanna make sure listeners understood. I mean, when I heard about that, that sounded like, wow, that is awesome if you can do it. I never tried it, but it sounded awesome.

Dr. Chiagozie Fawole: Yeah, it was actually pretty crazy. But then what then happened in the subsequent years was that rents began to go up and it became a lot harder to find where those numbers worked. But while I was interviewing the doctors and professionals for that conference and I was hearing their numbers, people were talking about buying property for 600,000 and then making 150 in revenue. I was like, wait, what exactly? But then I had ruled myself out of being able to buy short-term rentals then because I thought they were too expensive. But it was during that conference that I learned of the financing options that you could finance them at 10% down instead of 25% that I thought you had to do for investment property. So once that key was unlocked for me, within the next two months, we bought our first lake house and that marked the true, it marked our pivot into actually just buying. And so we started buying luxury lakefront property. And from a real estate standpoint, that's sort where we have now sat for the last three, four-ish years now.

John: OK that's a little busy you've done a lot in a few years. So are you now, do you still look for new opportunities there? Are you kind of satisfied with what you have? And then maybe you can tell us just how many you have or what they look like, something like that.

Dr. Chiagozie Fawole: So about two years ago, we were thinking of ramping up and ended up buying five properties in a very short timeframe. Most of them needed some work. And I thought, you know what, I've done renovations before, because our model really has involved renovating houses for the last, I mean, since we began, really. But it ended up being actually more challenging from basically every angle. Like at some point, the city shut us down for one of the properties. At some point, you know, one of them went over budget and ran out of cash. It was just very interesting. But at some point it began to stabilize and it was really, it ended up being really a journey of both faith and tenacity and, you know, just going through the motions and, but during all of this time, the idea of buying a business sort of began coming up. Okay. So it was now a case of like, okay, you don't need to, break yourself buying property. What if you just stabilize the one, actually like get through this hurdle, but while you're doing that, start to look for businesses.

And that was sort of how that transition, not really transition, or at least mindset thing began to transition. Because one thing that I found is that I love real estate. I love taking a house from, you know, ugly to pretty. But one thing I learned was that you need to have capital, not just available, but also in reserves. And after 10 years, you will think I would have known this already, this like having done this now with like multiple at one time, I realized, okay, don't do this to yourself. Like just take it easy, get your cash printing machine, which is a business of some sort. And then you can rehab to your heart's content. And that was when, you know, I mean, at that point I was, I was already, I had been building my coaching business for a while. So I knew that business has made money. But when all of these happened, it really just solidified in my mind that, okay, maybe the focus right now should really not just be on acquiring the property, but on acquiring something that then is that cash printing machine that then can fund the fun projects of renovating and doing the short-term rental thing.

John: Yeah, I mean, and they're probably... I mean, there's an infinite number of businesses that would tie to real estate. I'm assuming I could think of many, but, like my sister worked for someone who was a jeweler and she owned the jewelry business and she owned the building. And then she retired. My sister ran it for her and she was, you know, getting her percentage. He was good. Plus the rental on the building by the business. And so then, okay. So that sounds very intriguing. And I think people are going, oh, so how are they, how did you approach this and what direction were you going once that aha moment came?

Dr. Chiagozie Fawole: How happened? Yeah. So the first time the idea of even looking into businesses came to me was an online event that I attended back in 2020. But at the time it kind of seemed like, Oh my gosh, this is a really cute idea. But it didn't see like, it's almost like I didn't see it as something for me. It seemed like something for them. Like I'm in this room with these people buying businesses. I remember I even signed up for the guys course at the time. And I remember being in those rooms and just feeling like everything was like above my head. Like it felt like just this huge concept that will be nice one day, but I hadn't embodied that identity yet. It took about two years. It was in 2022. I then went to a different conference or event. And while I was sitting there, and talking to the people, actually, I remember it was on Sunday morning, I sat next to this lady who had actually just bought her first business.

And I was talking to her regular, you know, good old American woman with two kids, single mom, you know what I'm saying? Like very regular human being talking about the business that she acquired with no money down, that made 30K in the first month profit. And I'm listening to her like, this is flesh and blood. She's a human.

John: Sounds too good to be true, but let's see what happens.

Dr. Chiagozie Fawole: And just talking to her just unlocked something for me that, okay, like she can do it. I can do it. And so I, then I left that conference. Oh, and sorry, that same event. I also saw the numbers. I'm, that was when my eyes popped. When I saw the numbers and I sat next to the lady, was like, okay, we're doing this. This is it. I left that conference and on my way back, I mapped out my goals and vision or whatever. And within the next few months, I actually found a business that I wanted to buy. It looked great. The numbers looked great. It was a landscaping company in Maryland. It had, you know, like 18 or so employees. It was making the numbers that I would like. Before debt service, it was going to make me $425,000 a year. Yeah. Before debt service. After debt service, maybe take away about $180,000, maybe $200,000 from that. So I'd have walked away with maybe roughly $250,000 right there about. For a business that I would have bought for one point, I think it was 1.1 million. So 10% down on that would have been about 110 roughly. And it was great.

But then during due diligence, something came up and I was like, Oh my gosh, this seems so little to drop it. But then when I spoke with, I just happened to just be on a call with the guy that actually hosted that event I went for. And I was like, Oh, by the way, like the attorney and accountant are saying that this may be a no-go. He was like, tell me about it. And I told him, I was like, oh yeah, next one. I was like, what? What? Oh my gosh. That actually devastated me. Just like not devastated, like, you know, being all dramatic, but it almost felt like, oh my goodness. If I had simply called him before I sank all my money into due diligence, we could have known this before I spent $28,000 on due diligence. So for the next few months, just kind of like, took a step back, just like mentally recuperating from the deal, because I really liked that deal. And then I began my search again, I would say kind of towards the, actually the next year. Was it next year? No, no, no. In a few months, I began a new search with a new mentor and whatnot. But that was the first one. And then now we have another one that's also, because the mental part of all of it, but the numbers, once you see them, it's really hard to unsee.

John: Well, you know, it reminds me, I think the listeners know that my wife owned a business and she recently sold it. And we were... I mean, we were so open with all of our numbers. There was nothing hidden. So I think the buyer really felt good about it. But then there's a couple of things. I mean, I read through things my wife did the, you know, the offer and then the contract. But darn if my attorney didn't find one or two things that said this should not be in here. Now we were able to get rid of those things that at end of the day, you know, she was able to go ahead and sell. But I could see as a buyer having that same kind of, okay, there's something in here that could explode on me in a year from now or something, you know? And so you've just got to listen to those experts.

Dr. Chiagozie Fawole: You know, yeah, I learned that one because it was like. In my mind, it seemed like a very small thing. It was like a contractor versus employee designation. And I thought, oh, I mean, they're landscapers. They're probably all 10-99. It'll be okay. And I remember I even put it on a Facebook group. Like, is this a real issue? And people came out and they said, actually, Maryland tax collection makes the IRS look like puppies.

John: Okay

Dr. Chiagozie Fawole: And I was like OH.

John: And each state is different, right? in terms of what people have and the different rules or regs you may not be aware of if you live in a different state. All right. So take us on your journey then. Where are we now in terms of your learning as you go here? So you have an idea now, like kind of what's the ideal business for you or for people in general?

Dr. Chiagozie Fawole: Yeah. So initially I was looking for a home services business, and we're talking landscaping, pool companies, all of that, to kind of tie into my real estate background. But then at some point I shifted more so from the industries, now more so to just the numbers. And again, depending on who you're talking with at the time, those numbers will vary. But right now my buy box is that the business has to make more than a million dollars in revenue. And we have a cheat sheet for this, how your listeners can get afterwards.

John: Yeah. In the show notes.

Dr. Chiagozie Fawole: So it has to make at least a million dollars in revenue. And the reason for that is that for the most part, when, you're going to do this, you might as well get something that by the time you get it, it actually means something to you. So a million in revenue sort of like starting is like the business is, is like settled. Okay, because people don't just make a million still trying to figure things out. So at least a million at a minimum and then profit margins of 20% and above actually is more of 25 and up. Now, this is the one that I really use really often and that is 10 employees or more. And that is because, you know, for some people, for some business owners, it's them, their spouse, their, you know, son-in-law, brother-in-law, you know, family members, people that if you pay, they will all get a portion of that payout and could possibly leave. So you don't want to buy the business and then be left with just two people to work the business. Meanwhile, you've paid full enterprise value for a business that had about 10 people, you know, eight or even five people prior. So 10 is our cutoff. Now, will I look at a nine person business? Possibly, if the numbers are good enough, but... but really it's 10.

And then age of the business. So 10 or more years in business or more. So that way when we're not dealing with startups, they say how many percent of businesses go out of business in the first five years. So you don't want it to be that they are in the middle of their throws and then trying to sell the business and dump the business with someone and you now pick it up thinking it was all great. It's actually not that...

John: I've heard another, you know, it's like a similar strategy is there's a lot of people have started businesses 20 years ago and they're they want to get out. Now, they may have a 20 million dollar business you can't afford, but anyway, there's people in all kinds of businesses that are looking to get out. And some of them just want someone that they can trust to keep it going. They don't necessarily have to pay top dollar. It kind of sounds like you're looking at the same kind of thing.

Dr. Chiagozie Fawole: Yeah. Exactly. Yeah, because sometimes people ask me, but why would anybody sell a profitable business? It's like there are multiple reasons. They're tired, they're retiring. You know, some of them it's divorce, some of them it's they just want to move on. There are multiple reasons that people sell, but your job is irretrievable of what they tell you to actually go under the cover, raise the hood and take a look. And that's a due diligence piece that we're talking about.

John: Now, you mentioned it, I think, as you were talking about this, that sometimes they're just getting worn out and they can keep a business going for 10 years, maybe without following the best practices. They get in habits and they do things the old way. They don't even know about technology. I imagine coming in and using technology to streamline things. Makes a lot of sense.

Dr. Chiagozie Fawole: Yeah. So even as we look, that's one thing that we try to see that are there any inefficiencies right now that we could possibly add. For some businesses, when they come all dolled up, like if they're completely stabilized, you'll probably be paying a pretty high multiple for them because they know that they are good. But if you get them at a point where they're okay, they're profitable, they are functioning, but they have a couple of loose ends here that could be tied up, that could be an opportunity. Certainly what we look for as we search for them right now.

John: All right, do you have any out there you've looked at recently that fit in there? Because again, you're focusing on the financials. And is the business, the nature of the business all over the place or is it kind of down to a set type of business?

Dr. Chiagozie Fawole: Right now, I think my husband has successfully weaned me off the landscaping hype. I really wanted a landscaping company because in my mind, if I needed to do my backyard, why not just buy the company and then do the backyard? Because otherwise it would cost me $100,000. But now I've been weaned off that. I still like the home services space if the numbers work. I'm still looking at, I found a plumbing or HVAC company right now, I would happily take a look at that. I've come to also like equipment rentals because the few that I have looked at have been pretty solid. And actually right now we are looking at one like very seriously. But it's really, when it's not been real estate, it's kind of been in that heavy equipment zone. Also because those equipment companies tend to have a lot of equipment which will give you nice tax deductions on the back end.

John: This has been awesome. Okay, let's pause here because I need to do a promo for you in a way. Just because I actually listened to a bunch of lectures the other day that you produced in whatever was webinars with a bunch of different guests and I don't know if that's still available to people but Let's start with your website. Where can they find you and learn all about you?

Dr. Chiagozie Fawole: Yeah, so so primarily right right now if you go to savvydocevents.com that will be the first kind of window into our world. Yeah, but a very nice way would be even to just to grab that. Grab that cheat sheet of the five things to look for in a in a business you want to acquire and that will be savvydocevents.com/5things— number five.

John: OK, got it. Five things up with that in the show notes. And the website, of course. And then you don't mind the occasional inquiry on LinkedIn.

Dr. Chiagozie Fawole: Absolutely.

John: You can ignore those if you want.

Dr. Chiagozie Fawole: People reach out to me from LinkedIn, Facebook. I'm usually more on Facebook, but I do get LinkedIn notifications on my phone as well. But for those who want to just kind of see all the things that I post, it's probably going to be on Facebook to find me.

John: OK, excellent. OK, let's go back to what we were talking about. So let's just wrap it up in some way this way. So now with all the experience you've had, you're working on something right now. If someone was, let's say five, 10 years out of residency, they're half burned out. Now maybe they've paid all their loans off. They've got some money put aside. Maybe that isn't necessarily in a 401k or something. And they're thinking, yeah, I think I do want to maybe pursue something entrepreneurially. What would you tell them to start? Not really knowing what their interests are, you know, real estate business, something else.

Dr. Chiagozie Fawole: No, I would recommend that they buy one short-term rental because I truly believe that every doctor needs, I say every doctor needs a Doris because Doris was our first lake house. The reason is if you've never done anything entrepreneurial, it's like entrepreneurship on training wheels. You'll get the experience of going through a transaction, of negotiating, of actually getting it closed. The experience of having a place that you can actually get away to, you and your family, right? And you can also lock in some pretty hefty tax benefits by getting a short-term rental, not just any kind of rental, but a short-term rental that can possibly offset your W-2 income. But while you're doing that, then learning about buying a business, I think, will be the next move. And the reason that I put it that way is because, at least even with my clients to like redo a 90 day sprint and people can have a property in 90 days. So literally between now and what's, you know, now and July or now in August or whatever, you know, his gets, this gets released 90 days from now, you can start from absolute zero and be collecting bookings from your guests in a short term rental. So that can be done like that.

And then you can start learning about, you know, acquisitions and all those things, which it can happen quickly or it may take a little while, but at least you've begun to of grease those wheels of entrepreneurship, starting to sort of build the identity, because that's a huge piece of it too, the mental reworking of being a physician and entrepreneur. It's a whole mindset shift that happens. You start to kind of find yourself in circles asking questions that are nonclinical, making money that is not tied to being on call or being at work. It's a very good thing.

John: I think that's great advice. And then I think, you know, if you feel like you enjoy that, the idea of buying an existing business, having, you know, gone through starting one from scratch, albeit it's a, it's a franchise, so it helps the startup, but you know, there's eight, 10 years of, you know, struggling and then. She sold it after 16, so it worked out fine. But I like the idea of really focusing at some point if you have any interest in being an entrepreneur on the small business or medium business even. Let's see, I don't know if we touched on too, I was going to just say, what is Savvy Docs looking for in the future? And I think you did mention before we got out that you have some event coming up, which is probably not being promoted yet, but tell us about it people will listen to this four months from now.

Dr. Chiagozie Fawole: Absolutely. So you know how I mentioned that I went for a live in-person event? in 2022. Well, in December, I hosted a virtual event and people were asking me, there a course for this? And I was like, well, I don't have a course. But then I reached out to my mentor and I said, Hey, you want to teach something? And he agreed. So we actually hosted two iterations of this and people went through it. They loved it. But then I said, you know how I went for that event in 2022. Can we do it again? Can we do something like that for our people? And he agreed. So September 12th through the 14th, up here in Syracuse, New York, we will be hosting what's called Catalyst, a business acquisition bootcamp to help people get started.

And the idea is you come in one weekend, Friday, Saturday, and then finish up on Sunday. But one weekend, you will learn how to pick an industry, pick an niche, pick whatever, how to find good businesses, how to screen them, like I just told you. how to actually find them, like the actual mechanics of finding them, how to fund them. So both creative financing, deal structuring, different, you know, nuanced things that you can do with transactions, and then how to grow and scale them. So Mike, my business partner, he has bought over 50 businesses at this point. He's done over 50 deals. His current portfolio generates about $145 million annually. So he's done this quite a bit. And he's going to be teaching how he grows businesses. So his primary model is that he buys them, he grows them, and then he sells them. And he actually says, he's like, it's not the million dollars that you make annually from these businesses that really matters. It's more so what happens on the sales.

So he teaches how to grow them when you have them, using AI, automations, all of those things. And then how to prepare yourself for an exit. So it's not... I say like, it's not a fluffy event, okay? Cause he doesn't have to be there, right? I'm the one that called him. I'm the one that said, can you come teach our people? So he's like, yeah, it has to be to the point where somebody can come in and they learn what they need to know to be able to go out and go get deals done. And so yeah, September 12th through 14th up here in Syracuse, New York. And it's, if you want to check it out, it's savvydocevents.com/catalystlive. So C-A-T-A-L-I-S-T-L-I-V-E.

John: All right. That is going to be something to look forward to. And I'll definitely send a reminder out closer to, you know, it'll be in the podcast show notes for sure. But then down the road a few months, I'll maybe throw out a few more reminders to people. Maybe I'll show up with my wife.

Dr. Chiagozie Fawole: Hey!

John: That can be fun. All right. I think we're about out of time here. I want to let you get back to the rest of your life and your weekend. And it's already the weekend for you because you're an hour early than we are here in the Midwest. So, all right. I mean, I appreciate you coming on today. This has been really fun and I've learned a lot myself and we'll maybe keep in touch. Again, thanks for being here.

Dr. Chiagozie Fawole: Thanks for having me.

John: It's been my pleasure. Bye bye.

Sign up to receive email reminders, news, and free stuff every week!

Enter your name and email address below and I'll send you reminders each podcast episode, notices about nonclinical jobs, information about free and paid courses, and other curated information just for you.

Disclaimers:

Many of the links that I refer you to, and that you’ll find in the show notes, are affiliate links. That means that I receive a payment from the seller if you purchase the affiliate item using my link. Doing so has no effect on the price you are charged. And I only promote products and services that I believe are of high quality and will be useful to you, that I have personally used or am very familiar with.

The opinions expressed here are mine and my guest’s. While the information provided on the podcast is true and accurate to the best of my knowledge, there is no express or implied guarantee that using the methods discussed here will lead to success in your career, life, or business.

The information presented on this blog and related podcast is for entertainment and/or informational purposes only. It should not be construed as medical, legal, tax, or emotional advice. If you take action on the information provided on the blog or podcast, it is at your own risk. Always consult an attorney, accountant, career counselor, or other professional before making any major decisions about your career.

Leave A Comment

You must be logged in to post a comment.